Economic Crime and Corporate Transparency Act examined: A guide to avoiding failure-to-prevent fraud measures

The Payments Association

FEBRUARY 10, 2025

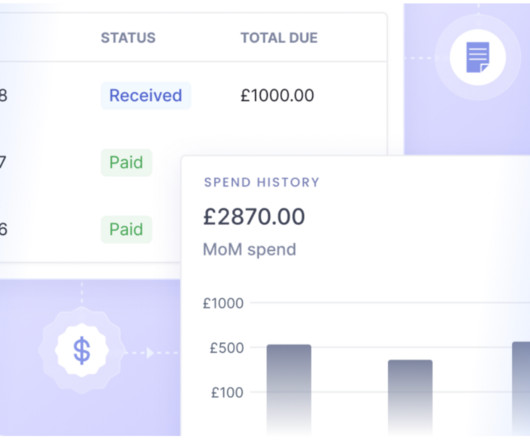

It highlights new corporate responsibilities, significant penalties for non-compliance, and the businesses need to implement strong fraud prevention measures to protect their financial and reputational standing. Due diligence : Ensuring employees and third parties adhere to anti-fraud policies. Why is it important?

Let's personalize your content