What is Reconciliation in Payments

Clearly Payments

APRIL 17, 2025

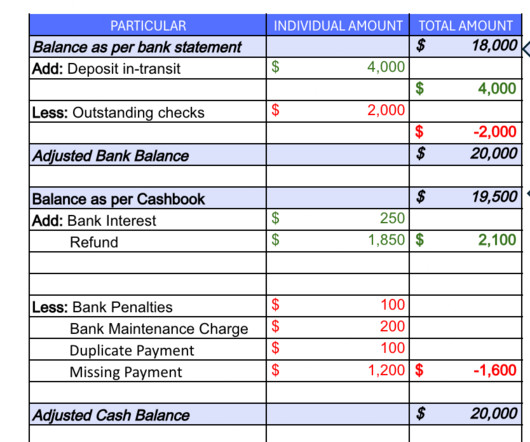

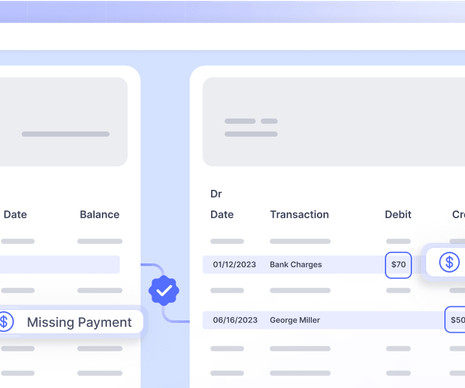

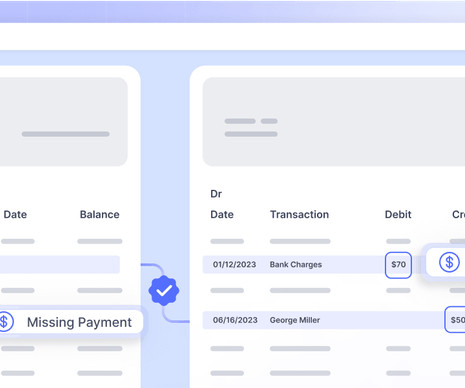

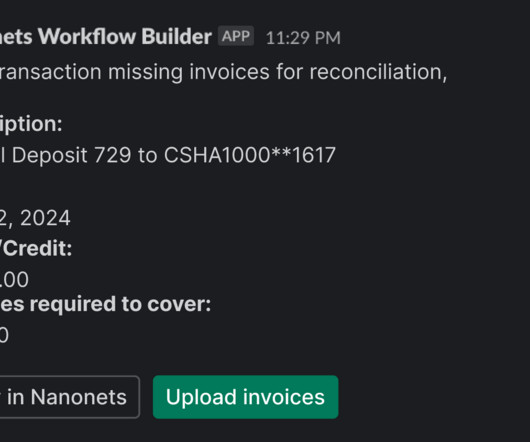

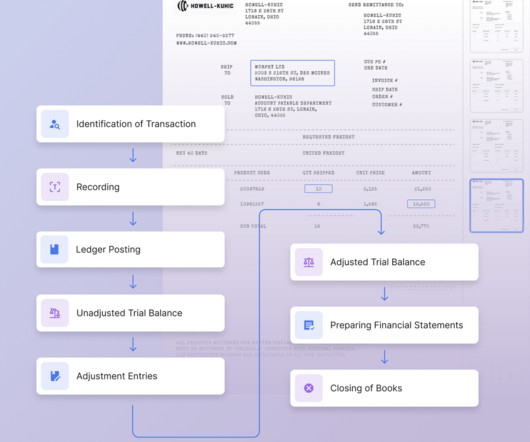

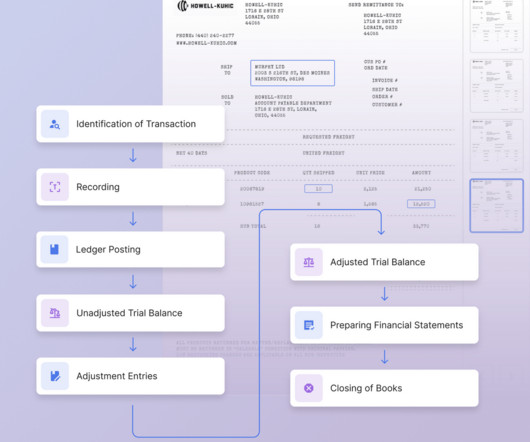

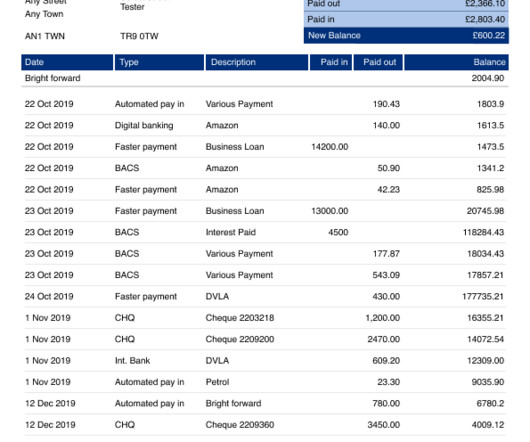

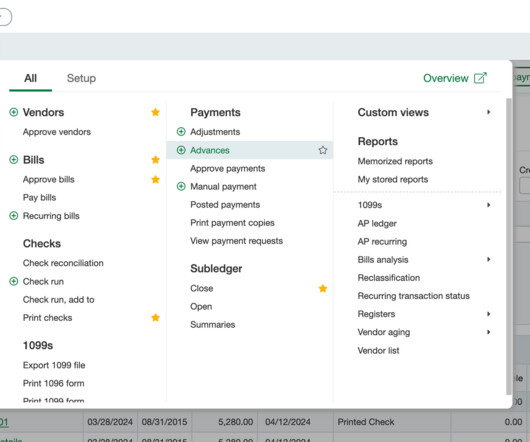

In payments and finance, one of the most important activities that businesses perform is reconciliation. While it may sound like a complex term, reconciliation is simply the process of making sure that two sets of financial records match. What is Reconciliation? At its core, reconciliation is a comparison process.

Let's personalize your content