What to Know About Tokenization

Basis Theory

NOVEMBER 12, 2024

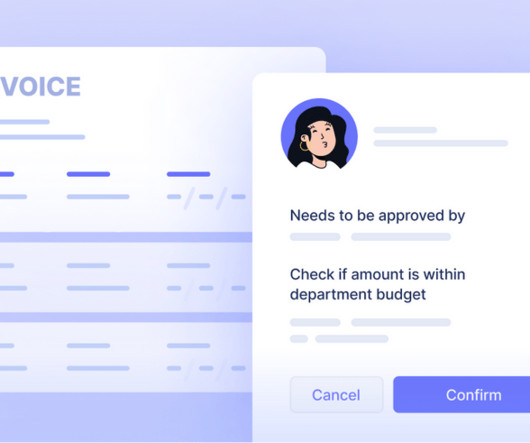

Additionally, they don’t want to be locked into a specific payment processor. They opt for a tokenization platform to process payments with many payment processors. The ciphertext is a computed value, based on a key and plaintext data. Encryption and tokenization are more different than they are similar.

Let's personalize your content