Medical record automation: How a leading underwriting provider transformed their document review process

Nanonets

APRIL 24, 2025

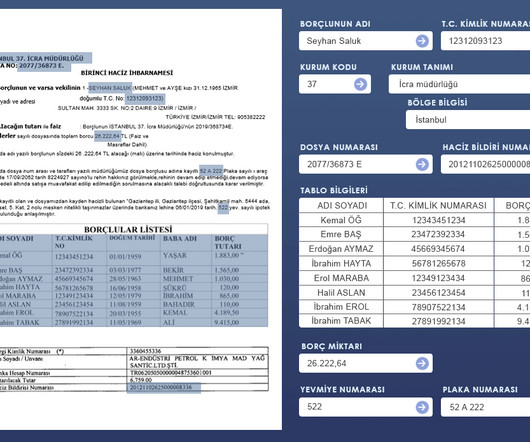

As healthcare digitization has surged from 10% in 2010 to 96% in 2023 , these firms now face overwhelming volumes of complex medical documents. One leading life settlement underwriter found their process breaking under new pressures. This is a story of how they did it.

Let's personalize your content