TreviPay Goes Live with New B2B Purchase Controls

Finovate

MARCH 31, 2025

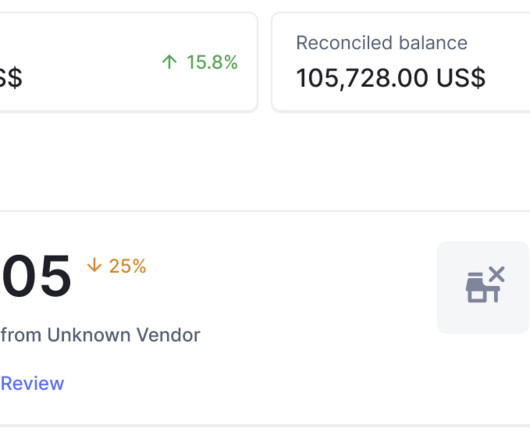

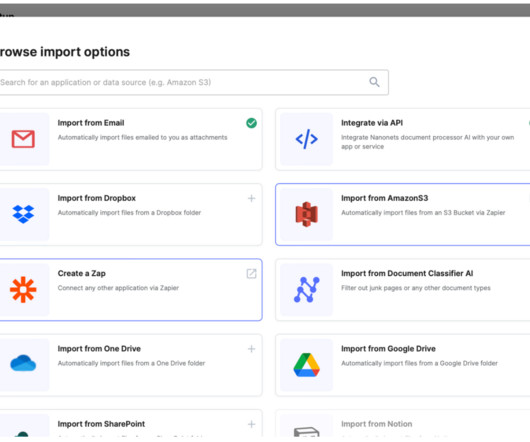

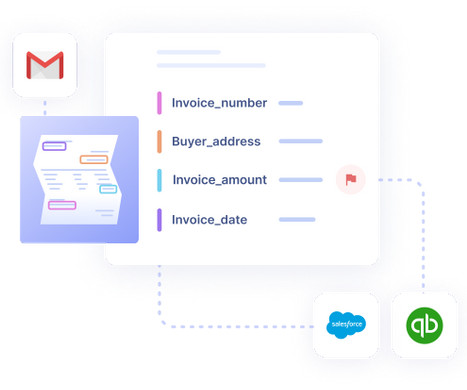

The controls will leverage automation to help reduce manual reconciliation activity and enhance compliance with procurement requirements. SBSN empowers banks to expand their offerings to small businesses by enabling them to access the small business B2B trade credit market.

Let's personalize your content