The Plan for Merchants to Reduce Chargebacks

Basis Theory

OCTOBER 10, 2024

Chargebacks damage budgets and reputations. Merchants need to have a plan to reduce chargebacks.

Basis Theory

OCTOBER 10, 2024

Chargebacks damage budgets and reputations. Merchants need to have a plan to reduce chargebacks.

PCI Security Standards

OCTOBER 8, 2024

The excitement is building as we get closer to this year’s Asia-Pacific Community Meeting ! To add to the anticipation, we’re giving you a sneak peek of some of the amazing sessions that will be featured in Hanoi, 20-21 November.

Payments Dive

OCTOBER 10, 2024

Gov. Kathy Hochul signed a new law Wednesday requiring merchants to use a gun code, saying it could help prevent mass shootings.

VISTA InfoSec

OCTOBER 7, 2024

Technology is always brimming with advancements, and it is more prominent in the financial sector. As financial institutions increasingly rely on digital infrastructure to enhance operations, customer experience, and security, they also face growing challenges in mitigating the risks that come with it, such as cyber threats, system failures, and other operational vulnerabilities.

Speaker: Jason Cottrell and Gireesh Sahukar

Retailers know the clock is ticking–legacy SAP Commerce support ends in 2026. Legacy platforms are becoming a liability burdened by complexity, rigidity, and mounting operational costs. But modernization isn’t just about swapping out systems, it’s about preparing for a future shaped by real-time interactions, AI powered buying assistants, and flexible commerce architecture.

Fintech News

OCTOBER 7, 2024

Capella Hotel Group has partnered with digital payment provider dtcpay to allow guests to pay using Digital Payment Tokens (DPTs). This option is now available at Capella Singapore and Patina Maldives, Fari Islands, where guests can settle their room bookings and other expenses with tokens like WUSD, USDT, USDC, Bitcoin, and Ethereum. At Capella Singapore, guests can complete transactions by scanning a QR code at the front desk using their digital wallets with the supported DPTs, while Patina Ma

Finextra

OCTOBER 6, 2024

PayPal has for the first time used its proprietary PYUSD stablecoin to pay and invoice.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Fintech Finance

OCTOBER 8, 2024

WadzChain Network, a global leader in innovative blockchain technology, announced today the launch of one of the world’s first hybrid blockchains intending to transform global payments for businesses. WadzChain’s user-friendly interface and a highly scalable platform offers the ideal solution for businesses looking for secure, scalable, fast and cost-effective transactions locally or across the globe over encrypted blockchain networks.

Fintech News

OCTOBER 10, 2024

Vietnam’s digital economy is rapidly expanding, reaching a value of US$30 billion in 2023 and projected to increase by 20% to hit US$43 billion by 2025. T his growth is fueled by technology adoption across businesses, the rise of key sectors including fintech, as well as rising middle-class incomes, a new report by Acclime Vietnam, a professional services provider from Ho Chi Minh City, says.

Finextra

OCTOBER 7, 2024

The value of ecommerce fraud is set to rise threefold in the next five years, thanks to the impact of AI.

Payments Dive

OCTOBER 11, 2024

The payments software provider announced a slew of new partnerships on Wednesday, also with Amazon and AMC Networks.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Fintech Finance

OCTOBER 9, 2024

Revolut , the global fintech with over 45 million retail customers and hundreds of thousands of business customers globally, is now giving Revolut Business merchants in the UK the option to accept American Express Cards as a payment method for ecommerce, including through Revolut Gateway, Payment Links, and Tap to Pay on iPhone payments – with more in-person payment solutions to come later this year.

Fintech News

OCTOBER 10, 2024

Fintech Alliance.PH announced that it will be joining the Singapore Fintech Festival 2024 to showcase its digital finance innovations. The event, one of the largest fintech gatherings globally, will be held from 6 to 8 November 2024, at the Singapore EXPO. Last year, Singapore Fintech Festival gathered 66,000 participants from 150 countries, and an even larger audience is expected this year.

Finextra

OCTOBER 9, 2024

According to Lloyds, two out of three financial institutions are already investing in AI. Discover why at Finextra’s inaugural NextGen: AI event this November.

Bank Automation

OCTOBER 9, 2024

Global venture capital funding took a hit in the third quarter, but AI startups accounted for 31% of all global funding. Venture capital funding for startups globally dropped 21% year over year to $54.7 billion in Q3, according to CB Insights’ State of Venture Funding Q3 report, published Oct. 3. “This is surprising, because we […] The post AI accounts for 31% of VC funding in Q3 appeared first on Bank Automation News.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

PCI Security Standards

OCTOBER 7, 2024

Welcome to our podcast series, Coffee with the Council. I'm Alicia Malone, Senior Manager of Public Relations for the PCI Security Standards Council. Today we'll meet one of the Council's newest employees, our Head of Product and Technology, Deanne Zettler. Deanne comes to the PCI SSC with more than 25 years of experience leading product and technology strategies, solutions and operations in financial services, including stops at Discover Financial Services and Silicon Valley Bank.

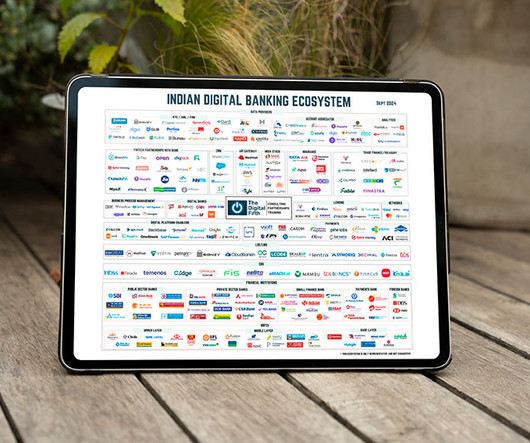

Fintech News

OCTOBER 10, 2024

The banking landscape in India has undergone a major transformation, driven by significant investments in digital infrastructure and innovations by both incumbents banks and new fintech entrants, a new analysis by the Digital Fifth, a fintech consulting and advisory firm in India, says. This dynamic ecosystem is supported by regulatory advancements and collaborative partnerships, which are expected to continue fostering innovation and growth in the sector.

Finextra

OCTOBER 10, 2024

TD Bank has agreed to pay $3 billion in penalties after pleading guilty to violating US anti-money laundering federal laws.

Bank Automation

OCTOBER 11, 2024

JPMorgan Chase expects AI and other new tech to increase employee productivity but remains wary of AI tech companies’ inflated valuations. “Tech valuations, or any valuations, won’t stand these very inflated values,” Chief Executive Jamie Dimon said during the bank’s third-quarter earnings call today. The bank has a significant cash surplus “sitting in the store” […] The post JPMorgan Chase warns of inflated AI tech valuations appeared first on Bank Automation News.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Payments Dive

OCTOBER 11, 2024

The department’s undersecretary for domestic finance, Nellie Liang, suggested state oversight of money transmitters was outdated in an era of electronic payments.

Fintech News

OCTOBER 6, 2024

Singapore is enhancing its anti-money laundering (AML) framework with new recommendations from the Inter-Ministerial Committee (IMC). This comes after a review sparked by the high-profile money laundering case in August 2023, in which more than S$3 billion worth of assets were seized. The IMC’s report outlines strategies aimed at strengthening prevention, improving detection, and enforcing tougher penalties to better protect the integrity of Singapore’s financial system against increasingl

Fintech Finance

OCTOBER 8, 2024

Trustly , the global leader in open banking payments, is excited to announce the appointment of Adam Miller as its new Group Chief Financial Officer (CFO). Based in Stockholm, Adam joins Trustly from Deliveroo, where he served as CFO for over two years, successfully leading the company through its 2021 London Stock Exchange listing and navigating significant growth during the pandemic.

Bank Automation

OCTOBER 7, 2024

Some financial institutions are decreasing their branch footprint as bank clients increasingly adopt digital offerings while Bank of America and JPMorgan are investing in their branch capabilities to meet evolving client needs. The case for expanding branch networks lies in evolving customer preferences, the role of the branch and tailored solutions, Joe Myers, executive vice […] The post Bank of America, JPMorgan invest in branch networks appeared first on Bank Automation News.

Speaker: Benjamin Woll, Tiffany Spizzo, and Jaime Santos Alcón

Enterprise commerce is at an inflection point. Rigid, monolithic platforms slow brands down, but a full replatforming is disruptive and costly. Modular architecture offers a flexible, scalable alternative - allowing enterprise brands to modernize without ripping and replacing their entire stack. Learn how a composable approach helps modernize commerce stacks while maintaining control over critical systems.

Payments Dive

OCTOBER 7, 2024

Fiserv has allowed Zūm Rails to use its embedded finance system to bring open banking and instant payments to Fiserv’s U.S. business customers.

Fintech News

OCTOBER 7, 2024

Singaporean payment provider FOMO Pay has partnered with Visa to allow SMEs to accept Visa credit and debit card payments through the national SGQR code system. FOMO Pay becomes the first Visa QR acquirer and processor in Singapore as part of this collaboration. This move comes as QR code payments gain popularity in Southeast Asia, with nearly three in five consumers in the region now using them.

Clearly Payments

OCTOBER 10, 2024

Loyalty programs have become an integral part of shopping, offering businesses a way to build stronger customer relationships, increase retention, and drive sales. Loyalty programs can boost overall revenue for merchants by 5 to 10%. In payment processing, loyalty programs also play an important role, enhancing the transaction experience for both merchants and consumers.

Fintech Finance

OCTOBER 11, 2024

Klarna , the AI-powered global payments network and shopping assistant, has released data on its launch of cashback. In the six weeks since launch: 506,378 Klarna shoppers have earned $2.7m dollars in cashback. Klarna merchants have given cashback on $98.4m worth of sales. Over 1,000 cashback promotions have been launched. Klarna launched cashback in 12 countries simultaneously on 15 August, to reward consumers who shop in the Klarna app.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Finovate

OCTOBER 11, 2024

This week’s edition of Finovate Global features news from the fintech scene in Hong Kong. Worldline partners with BOCHK International payment services company Worldline has forged a partnership with the Bank of China (Hong Kong), also known as BOCHK. The partnership makes the bank the first Hong Kong-based customer of Worldline’s open platform card solution, Paysuite Essential Edition.

Fintech News

OCTOBER 7, 2024

Digital bank GXS has launched the GXS FlexiCard , a credit card that charges flat fees on outstanding balances rather than traditional revolving interest. This card is designed for consumers who may struggle to access credit products due to being new to credit or having limited credit history, such as new professionals, gig workers, and entrepreneurs, offering a credit limit of S$500.

Clearly Payments

OCTOBER 7, 2024

The COVID-19 pandemic has reshaped industries and economies worldwide. Among the sectors affected is the payment processing industry , which has undergone rapid transformation in response to the unprecedented challenges posed by the pandemic. As of 2024, it is clear that the changes initiated during the pandemic are not just temporary adjustments but enduring shifts that continue to define the industry’s trajectory.

Fintech Finance

OCTOBER 9, 2024

SEPAmail.eu and CBI joins their IBAN-Name Check expertise at the service of their respective communities in order to offer an interoperable solution to fight against fraud. This partnership enables the Italian and French communities, via their PSP, to secure their cross-border payments in offering a high added-value service to meet the requirements of the Instant Payment Regulation and beyond.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

Let's personalize your content