Tietoevry Banking Registration Enables it to Verify Payer and Payee Identities for European Banks

The Fintech Times

JANUARY 7, 2025

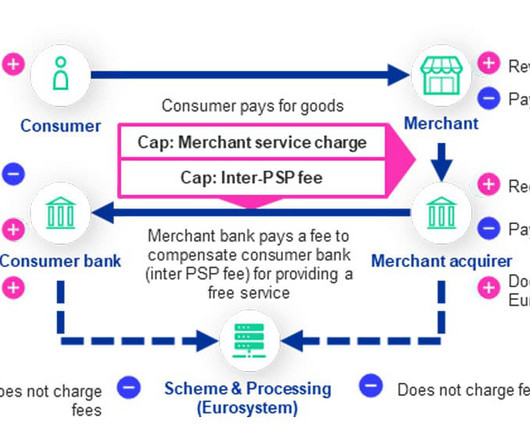

Tietoevry Banking , a financial software solution provider based in the Nordics, has registered with the European Payments Council as a provider of routing and verification mechanisms (RVM) for verification of payee (VoP) solutions.

Let's personalize your content