Payment orchestration: Beyond transaction routing

The Payments Association

MAY 16, 2025

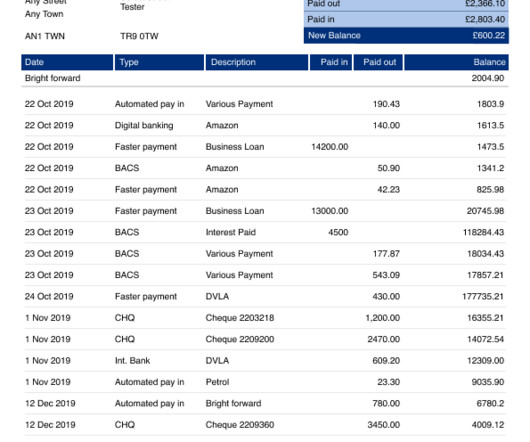

This visibility enables data-driven decision-making and facilitates effective troubleshooting of issues like high decline rates or chargebacks. Additionally, centralised reporting simplifies financial reconciliation and compliance efforts, enhancing control and accountability for finance and operations teams.

Let's personalize your content