Merchant Underwriting: What It Is, How It Works, and Why It’s Important

Stax

JANUARY 23, 2025

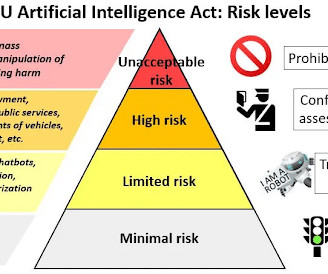

Ensure regulatory compliance by adhering to anti-money laundering (AML) laws and Know Your Customer (KYC) requirements. How Merchant Underwriting Works The merchant underwriting process typically follows a few steps carried out by the payment facilitators or acquiring bank to develop an underwriting risk profile.

Let's personalize your content