Navigating the rise of AI-enabled fraud

The Payments Association

DECEMBER 10, 2024

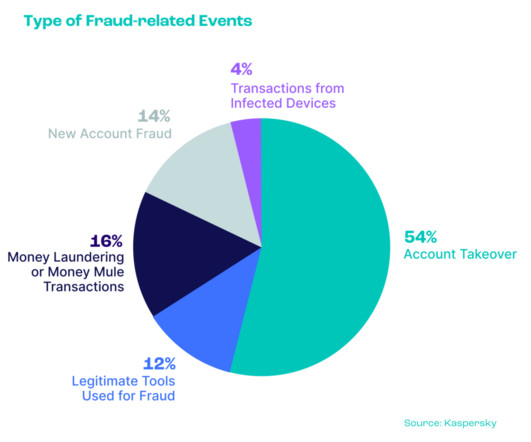

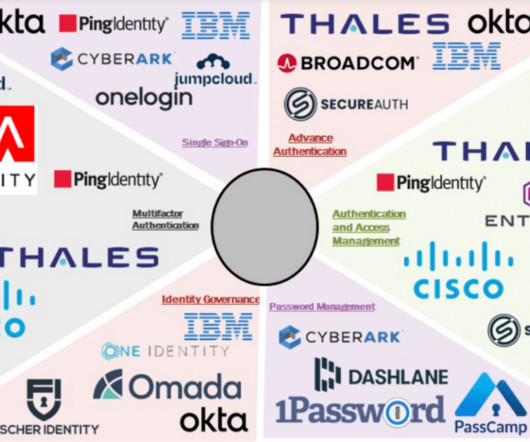

As payment systems become more digitised and interconnected, the attack surface expands, and the stakes for payments firms to invest in robust, AI-driven fraud detection and prevention systems have never been higher. fingerprints, facial recognition), and behavioural biometrics (e.g., keystroke dynamics or mouse movements).

Let's personalize your content