Hawk Raises $56 Million in Series C Funding to Help Banks Fight Financial Crime

Finovate

APRIL 8, 2025

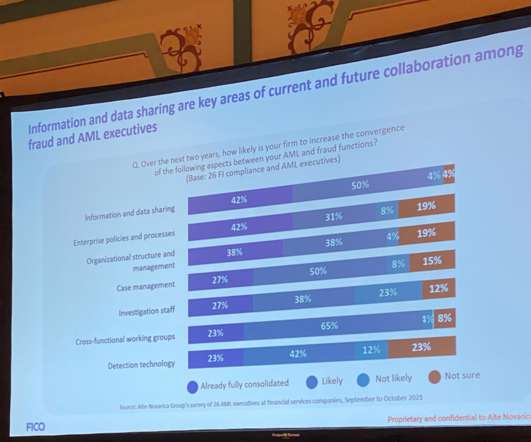

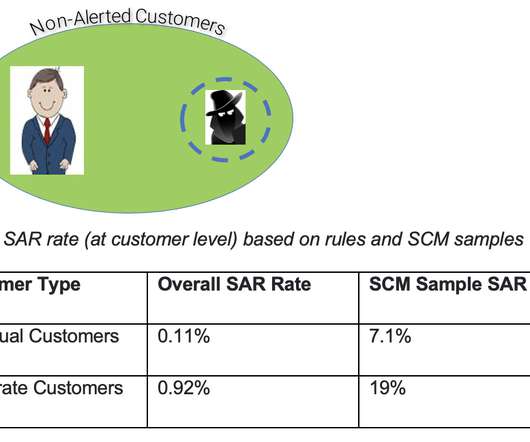

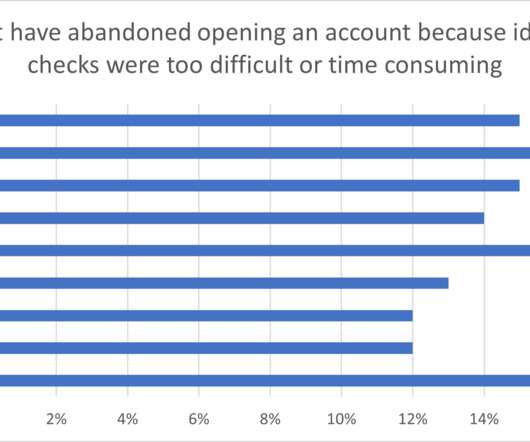

Hawk made its Finovate debut at FinovateSpring 2022 in San Francisco. Hawk , a company offering AI-powered anti-money laundering (AML), screening, and fraud prevention solutions, has secured $56 million in Series C funding. This drives up the cost of fighting financial crime. The company was founded in 2018.

Let's personalize your content