How Financial Institutions Can Combat Business Email Compromise (BEC)

Fi911

JUNE 9, 2025

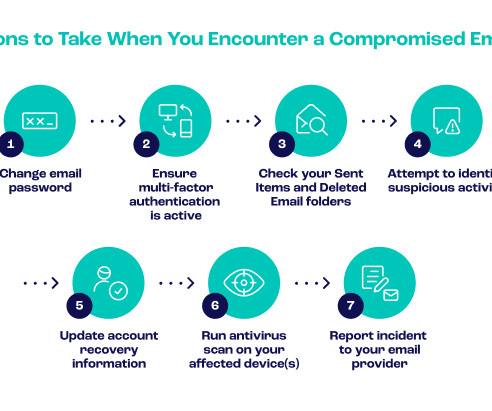

Business email compromise attacks cost organizations $2.4 Attackers compromise vendor email accounts, then send updated banking instructions just before scheduled payments. By the time anyone notices, funds have moved through multiple accounts and jurisdictions. Continuous monitoring catches compromises early.

Let's personalize your content