Accepting Online Payments with Internet Merchant Accounts

EBizCharge

NOVEMBER 27, 2024

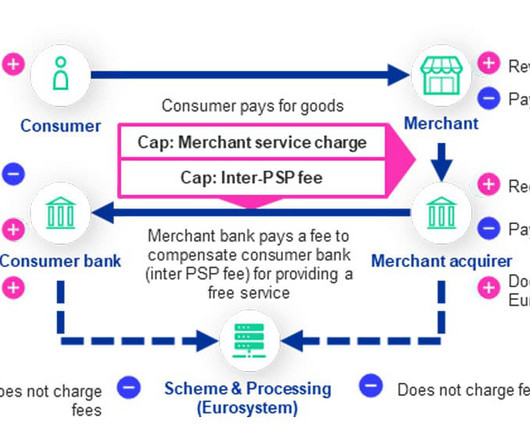

Enter the Internet merchant account, a key player in this financial ecosystem. By understanding the components and processes involved in Internet merchant accounts, businesses can streamline their payment operations and provide a seamless shopping experience. What is an Internet merchant account?

Let's personalize your content