TreviPay Unveils Advanced Purchase Controls to Enhance B2B Commerce Experiences

The Fintech Times

MARCH 28, 2025

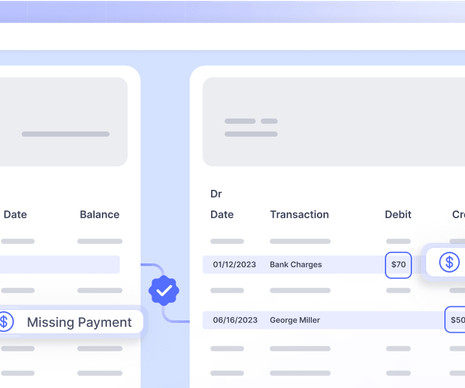

TreviPay , the B2B payments and invoicing network, has launched advanced purchase controls to address pain points in the B2B purchasing process for its clients. ” The post TreviPay Unveils Advanced Purchase Controls to Enhance B2B Commerce Experiences appeared first on The Fintech Times.

Let's personalize your content