PCI Compliance for Banking Professionals

Fi911

FEBRUARY 26, 2025

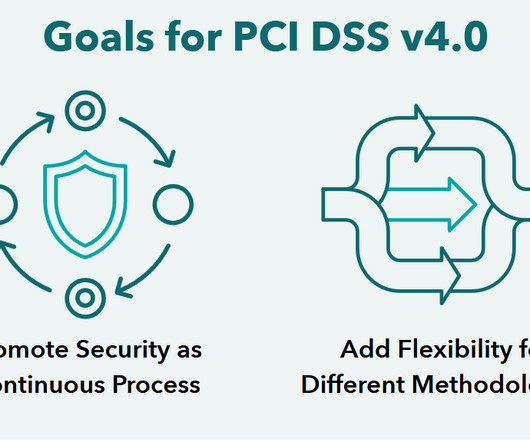

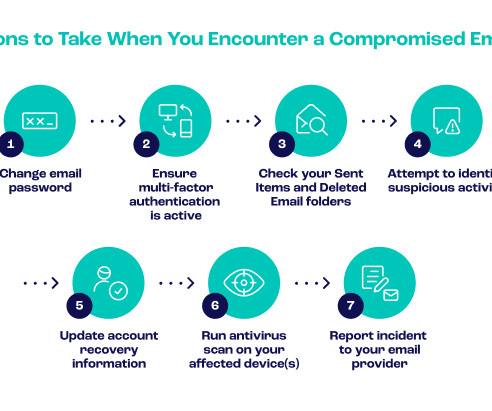

Identify and Authenticate Access to System Components: Use multi-factor authentication (MFA) to strengthen access controls. Enhanced Authentication Strengthened requirements for authentication methods, such as mandatory MFA for all access to cardholder data. Continually assess and refine your systems to address evolving threats.

Let's personalize your content