The role of artificial intelligence in enhancing AML and regulatory compliance in fintech

The Payments Association

MARCH 25, 2025

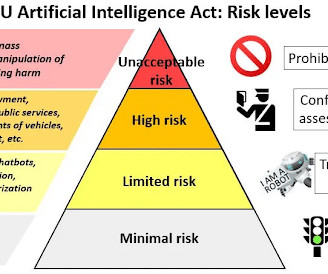

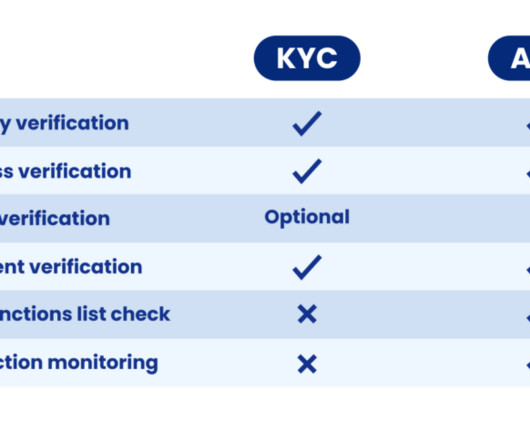

AML compliance requires risk assessment, transaction monitoring, and reporting suspicious activity. Traditional methods struggle against evolving financial crimes, but AI enhances efficiency, accuracy, and compliance. These systems enhance our security framework and ensure smooth, uninterrupted customer service.

Let's personalize your content