Driving Efficiency in Loans Against Mutual Funds with Tailored Loan Management System (LMS)

M2P Fintech

APRIL 10, 2025

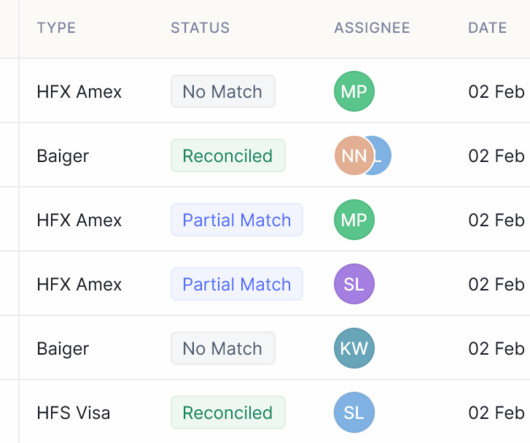

Automated Credit Limit Management for Risk Mitigation Tracks daily NAV fluctuations and collateral value changes to dynamically adjust credit availability through real-time limit management systems. Proactive LTV Management Dynamically adjusts LTV ratios to daily NAV fluctuations, safeguarding lender security amid market shifts.

Let's personalize your content