Chargebacks: A Survival Guide

Cardfellow

JUNE 25, 2025

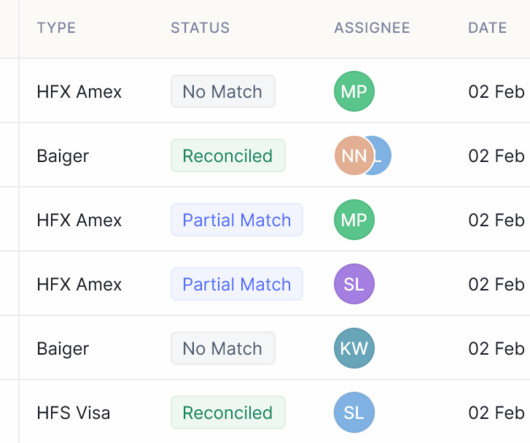

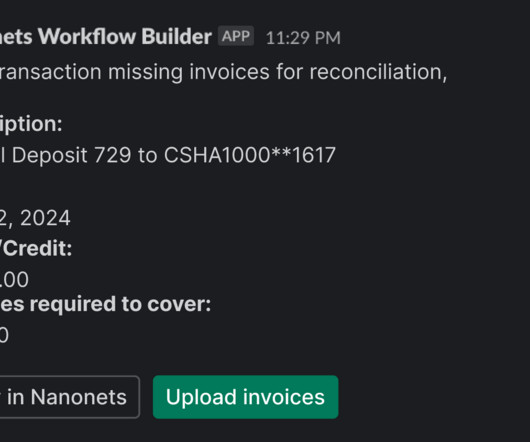

Once a customer has disputed a charge, a your acquiring bank will begin going through a specific procedure to resolve the issue. Duplicate Processing / Paid by Other Means 12.7: Duplicate Processing / Paid by Other Means 12.7: You’ll need to assess the pros and cons for your business if and when the situation arises.

Let's personalize your content