Safeguarding changes: assessing the impact

The Payments Association

JANUARY 22, 2025

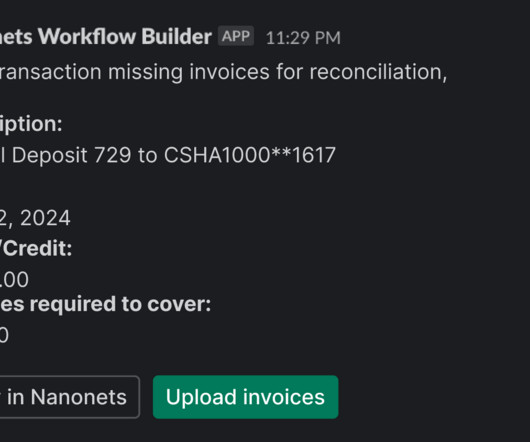

What to expect: Kieran Millar, principal product manager at AutoRek, will discuss safeguarding reconciliation concepts, record-keeping practices, governance, and reporting requirements. Join us at our upcoming webinar, where well unpack these key themes and share insights on the future of the payments industry.

Let's personalize your content