Future of Loan Management Systems: Predictions for the Next Decade, 2025-2035

M2P Fintech

MARCH 24, 2025

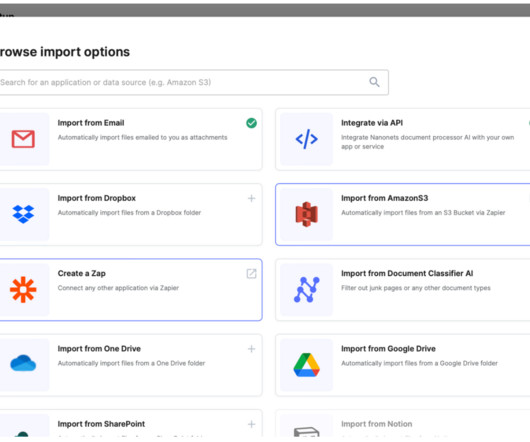

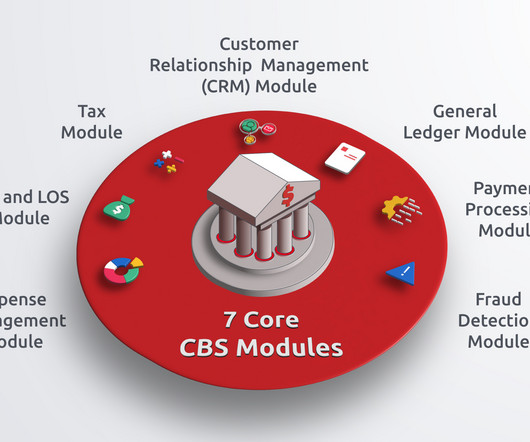

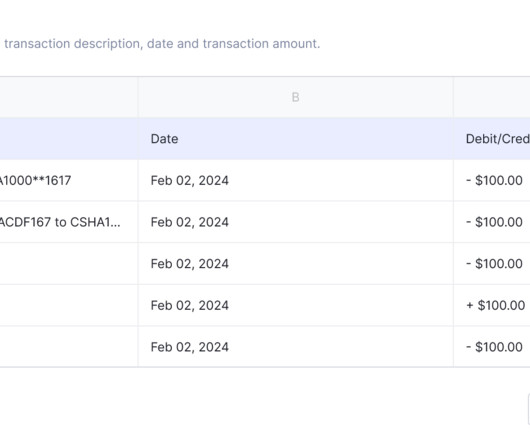

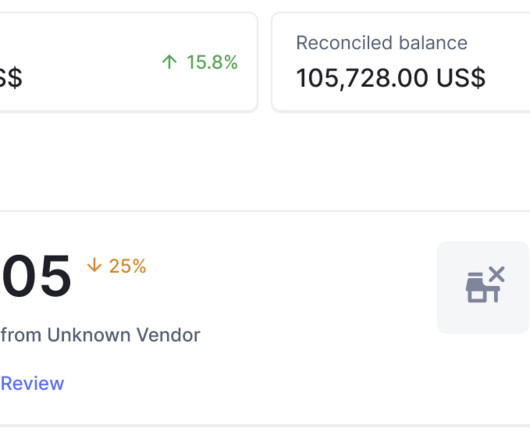

This includes employing machine learning algorithms to automate parts of the loan application and underwriting process, as well as using digital platforms to facilitate communication between borrowers, lenders, and other relevant parties. For instance, the increase in use of digital and automated processes is likely to continue.

Let's personalize your content