The rise of generative AI in payment security: A double-edged sword for data privacy

The Payments Association

DECEMBER 9, 2024

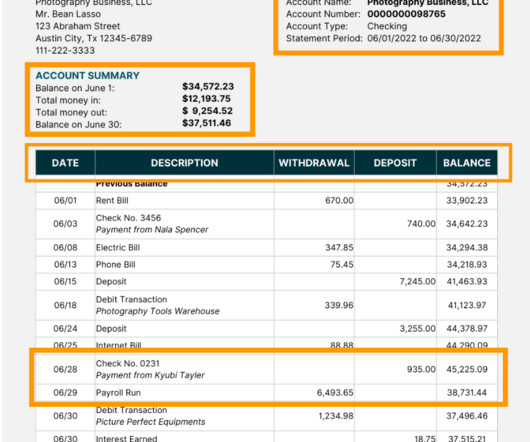

The dual impact of generative AI on payment security, highlighting its potential to enhance fraud detection while posing significant data privacy risks. From fraud detection to customer support, AI-driven solutions are revolutionising how payments are processed and safeguarded. What is this article about?

Let's personalize your content