Top regulatory priorities for the payments sector

The Payments Association

FEBRUARY 14, 2025

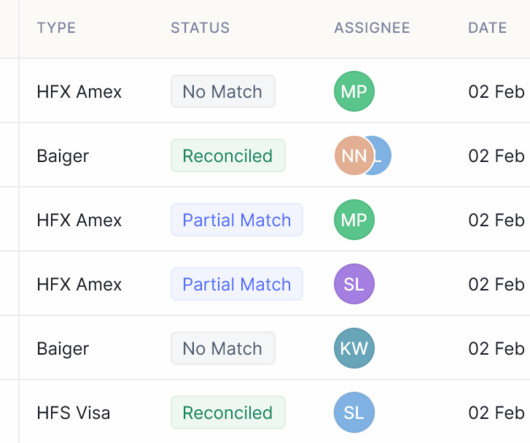

Regular audits and compliance checks : Firms will face enhanced monitoring and reporting under the proposed policy. They should implement regular audits and strengthen compliance oversight to uphold safeguarding practices. Engaging external auditors may provide additional assurance.

Let's personalize your content