Sumsub Leverages Device Intelligence to Monitor Fraud Activity in Real Time

Fintech News

JUNE 17, 2025

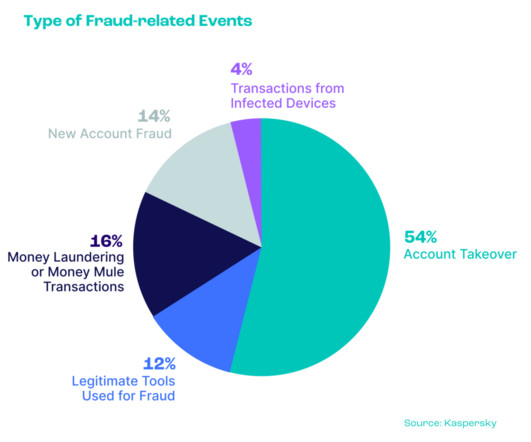

Sumsub has expanded its fraud prevention capabilities by integrating advanced device intelligence from Fingerprint, a provider of real-time device signal analysis. This allows companies to detect threats such as bot activity, account takeovers, and multi-accounting without relying on personal data or interrupting user experiences.

Let's personalize your content