AI x Payments: From Fraud Detection to Hyperpersonalised Checkout

Finextra

JUNE 25, 2025

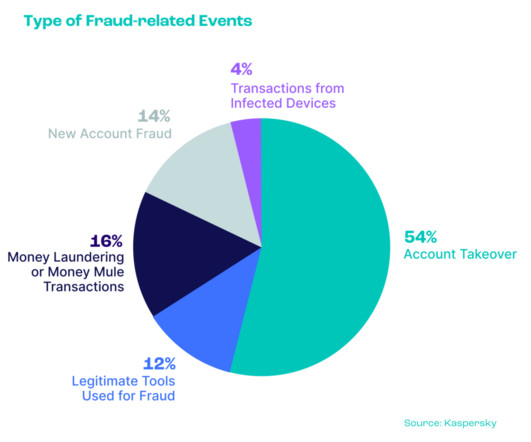

Real-Time Fraud Detection: Defence at Machine Speed Traditional fraud systems rely on static rules and after-the-fact analysis. But fraud doesn’t wait, and neither can protection. Predictive analytics identify emerging fraud patterns. Behavioural biometrics distinguish real users from bots or synthetic identities.

Let's personalize your content