Credit Card Settlements Explained: How They Influence Your Finances

EBizCharge

DECEMBER 3, 2024

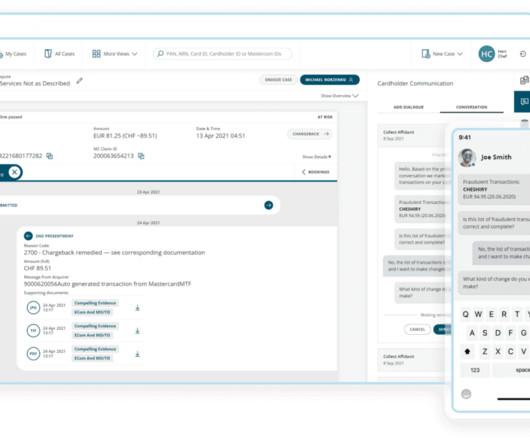

The payment settlement process involves various intermediaries, including the card issuer, the acquiring bank, and the payment processor. This makes settlement a crucial step in maintaining business liquidity. The choice between gross and net settlements often depends on merchants’ preferences and payment processors’ policies.

Let's personalize your content