Card issuers defend late fees

Payments Dive

JULY 6, 2023

senators, the top 10 credit card issuers outlined their late fee practices and warned of potential consequences if fees are capped as the CFPB has proposed. In responses to a group of U.S.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Dive

JULY 6, 2023

senators, the top 10 credit card issuers outlined their late fee practices and warned of potential consequences if fees are capped as the CFPB has proposed. In responses to a group of U.S.

Stax

DECEMBER 20, 2023

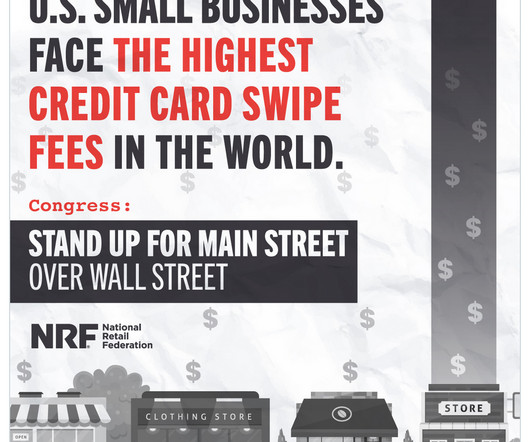

Interchange is the fee that credit card companies like Visa and Mastercard charge businesses to accept their cards. In this article, we will break down credit card interchange fees so you will know exactly how much you’re spending when running your business. Request Quote What Are Interchange Fees?

Stax

SEPTEMBER 26, 2024

Credit card surcharges are increasingly becoming a fact of life. Industry data shows that 9 out of 10 credit card users say they don’t want to pay surcharges but do it anyway. That said, you can’t just decide and impose credit card surcharges overnight. Learn More What is a Credit Card Surcharge?

Stax

JANUARY 24, 2024

Credit cards remain a favored way of making payments among customers. Purchase volumes through credit cards jumped 51% between 2015 and 2021. However, the idea of applying a credit card surcharge to offset the processing cost of credit cards has always been a hotly debated topic.

Stax

JANUARY 24, 2024

Credit cards remain a favored way of making payments among customers. Purchase volumes through credit cards jumped 51% between 2015 and 2021. However, the idea of applying a credit card surcharge to offset the processing cost of credit cards has always been a hotly debated topic.

Payments Source

APRIL 24, 2016

It didn't take long for debit card issuers affected by the Durbin amendment fee caps to cut back or eliminate rewards programs to recoup costs. Issuers now engaged in the increasingly competitive credit card rewards and loyalty environment may soon have to face that same decision.

Electronic Payments Coalition

FEBRUARY 28, 2024

WASHINGTON, DC — It’s been nearly 15 years since the Durbin Amendment imposed price caps and routing mandates on debit cards, financially burdening small businesses, while corporate mega-stores, like Walmart and Target, have accumulated substantial revenue gains.

Finextra

MARCH 5, 2024

The Consumer Financial Protection Bureau (CFPB) finalized a rule today to cut excessive credit card late fees by closing a loophole exploited by large card issuers.

Payments Dive

JULY 18, 2023

The CEO of the private label card issuer expects a final rule on the CFPB’s proposed credit card late fee cap later this year, and litigation could follow, he said.

PYMNTS

MAY 13, 2019

The proposed credit card interest rate cap legislation , courtesy of Democratic presidential hopeful Senator Bernie Sanders and Rep. Alexandria Ocasio-Cortez is in serious need of an almost half-century-old refresher course in the unintended consequences of price caps on the American consumer. Here’s why.

PYMNTS

SEPTEMBER 17, 2020

The way the rewards programs work is that airlines sell miles to banks, and the banks use them as credit card rewards to attract the wealthier customers they want as cardholders. where there are no caps on credit card transaction fees, FT reported. The loyalty programs are especially golden in the U.S.,

Stax

AUGUST 1, 2024

One way to do that—though often overlooked—is to optimize their payment processing to reduce fees associated with credit card purchases. Card companies like Visa, Mastercard, Discover, etc. charge interchange fees which, on top of other credit card processing fees, can eat away at your profits.

Stax

APRIL 4, 2024

Credit cards are incredibly popular, and it’s easy to see why: they’re convenient and accepted nearly everywhere. But as great as they are for consumers, merchants know that accepting credit card payments comes with added costs in the form of processing fees. Credit card surcharging is legal in most U.S.

EBizCharge

JULY 10, 2024

Understanding the nuances of a business charge card versus a credit card is essential for any company looking to optimize its purchasing power and financial management. Charge cards, often overshadowed by their credit card cousins, offer unique benefits for businesses.

FICO

MARCH 19, 2018

In our proprietary P&L Insight Benchmark Reporting Service , FICO has seen some worrying signs for UK credit card accounts 1-5 years on book ; these accounts are showing high lines, high spend and increasing delinquency. Others have suggested capping the level of interest that a bankcard issuer can charge.

Stax

DECEMBER 6, 2023

In an era defined by digital transactions and cashless payments, the process of paying for goods and services is more convenient, and increasingly reliant on credit card transactions. However, as the popularity of credit cards and digital wallet payments continues to surge, the costs associated with accepting them also do.

Cardfellow

SEPTEMBER 30, 2023

You may remember Senator Durbin’s name as the senator behind the Durbin Amendment , the bill that is responsible for regulated interchange on debit cards issued by large banks and permitted minimum charges on credit cards. Now, Senator Durbin hopes to take on credit card interchange fees.

FICO

NOVEMBER 16, 2021

Our monthly UK Credit Market Report analyzing UK credit card trends for September 2021 shows the contrasting conditions that have been seen throughout 2021 continue. UK Card average spend falls for third time in 2021. The average spend on UK credit cards in September 2021 decreased £3 to £708. Looking ahead.

Stax

DECEMBER 20, 2023

In the complicated world of payment processing, understanding the nuances of debit card and credit card payments, along with associated processing fees, is essential for businesses. TL;DR Card brands such as Visa and MasterCard along with state and federal laws prohibit debit card surcharging.

PYMNTS

SEPTEMBER 8, 2017

But, while debit cards are on the rise, the study shows credit cards’ share fell by two percentage points to 20 percent in 2016 and is set to continue to decline in certain areas. In the EU, interchange fee caps have limited the profitability for card issuers, while banks in the U.K.

PYMNTS

JULY 6, 2020

This month’s Deep Dive examines how the pandemic has spurred greater touchless payment method adoption and how card issuers, networks and other players in the space are responding. . Safety Concerns Encourage Contactless Card Use . percent of cards in circulation at that time were capable of making such payments.

Clearly Payments

FEBRUARY 12, 2024

At the forefront of payment industry, particularly in credit cards, are two giants: Visa and Mastercard. Bank of America launched the BankAmericard in 1958, widely considered the first credit card available to consumers, which eventually evolved into Visa. UnionPay has 32% of the global credit card market.

Stax

JANUARY 31, 2024

If your company accepts credit card payments ( which it should ), chances are, you’re going to be affected by Visa’s interchange rates. cards currently in use. So it’s virtually impossible for a business to not accept Visa cards. TL;DR Interchange rates are the fees charged by credit card networks.

Electronic Payments Coalition

MARCH 26, 2024

merchants, more than 90 percent of which are small businesses, lowering credit interchange rates and capping those rates into 2030. The settlement will reduce credit interchange rates for U.S. credit card interchange rates for at least a five-year period as part of a legal settlement with merchants.

Stax

MARCH 14, 2024

While wire transfers and checks are quite common, the corporate credit card market is projected to have a compound annual growth rate (CAGR) of 7.3% by 2026 , so we’ll likely see more credit card use in the business sector. ACH payments take up to three days to process and cost around 1% of the transaction with a $10 cap.

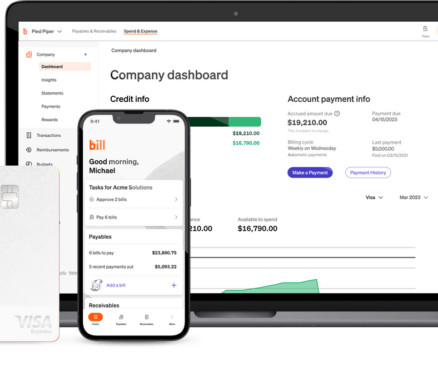

Fintech Labs Insights

OCTOBER 1, 2024

The intelligent way to create and pay bills, send invoices, manage expenses, control budgets, and access the credit your business needs to grow—all on one platform. Get Started Founded: 2016 | HQ: Utah | Funding: $418M Below is a list of the 17 challenger business credit cards currently active in the United States.

Cardfellow

FEBRUARY 27, 2025

Signature debit, sometimes referred to as running as credit means that the transaction will be processed on the network of the credit card company whose logo is on the card. It also blocks the card networks from restricting the networks that a business (or card issuer) can choose. But which network?

Fintech Labs Insights

APRIL 24, 2025

Below is a list of the 19 challenger business credit cards currently active in the United States. dollars) Definition : Charge cards require the balance to be paid in full each month; credit cards allow the balance to be rolled over, often at a relatively high interest rate). 2,065 reviews, up 15 since Jan) 2.

Fintech Labs Insights

DECEMBER 1, 2021

Below is a ranked list of the 17 challenger business credit cards currently active in the United States. Definition : Charge cards require the balance to be paid in full each month; credit cards allow the balance to be rolled over, often at a relatively high interest rate). Battling the Airline Rewards Cards.

Fintech Labs Insights

DECEMBER 1, 2021

Below is a ranked list of the 17 challenger business credit cards currently active in the United States. Definition : Charge cards require the balance to be paid in full each month; credit cards allow the balance to be rolled over, often at a relatively high interest rate). Battling the Airline Rewards Cards.

Fintech Labs Insights

JANUARY 24, 2025

This constantly updated article tracks the biggest and most important new products released worldwide by financial technology companies, along with banks, credit unions, investment advisors, insurance companies, credit card issuers and payment providers. Well also link to important demos, podcasts and YouTube videos.

CB Insights

DECEMBER 4, 2019

In March 2019, Amazon announced an integration with Worldpay , which serves as a back-end intermediary between banks and credit card companies and is one of the largest payment processors in the world. With the card, parents can manage spending limits and allocate funds for their children through a mobile app. Amazon Cash.

Fintech Labs Insights

DECEMBER 23, 2015

Since credit card issuers were required to increase their prime rate by the same amount, the company is not concerned it will push away borrowers. The market cap is at $4.32 Yesterday peer-to-peer lending platform, Lending Club [NYSE: LC], offered one answer. The company went public in December 2014.

PYMNTS

DECEMBER 27, 2018

In November, Chase , the largest card issuer in the U.S., announced it’s rolling out tap-to-pay functionality across its Chase Visa card portfolio. As customers open new accounts, or as their cards are renewed, credit cards — then debit cards — will join the contactless pantheon in the latter half of 2019.

PYMNTS

JUNE 21, 2019

Seventy-one percent of respondents said credit cards were imperative when deciding the FIs with which they want to do business, for example. Approximately 60 percent of credit unions — 92.7 percent of all CU members — currently offer some sort of credit card. Credit unions held $61.5

PYMNTS

MAY 9, 2019

Alexandria Ocasio-Cortez moved today to introduce legislation that would cap rates on credit cards and other consumer financial services at 15 percent. In an announcement on Thursday (May 9), Sanders and Ocasio-Cortez accused banks and other credit card issuers of acting as “modern-day loan sharks.”

The Fintech Times

OCTOBER 30, 2024

The report reveals that 76 per cent of surveyed firms initiated AI projects since 2023, with fintech challengers like Chime, Nubank and Gusto deploying AI at rates comparable to industry giants despite smaller market caps.

Fintech Labs Insights

JANUARY 9, 2025

Below is a list of the 17 challenger business credit cards currently active in the United States. dollars) Definition : Charge cards require the balance to be paid in full each month; credit cards allow the balance to be rolled over, often at a relatively high interest rate). 2,040 reviews, up 10 since Sep) 2.

Payments Dive

SEPTEMBER 30, 2024

Fewer people would be approved for credit cards, and credit card issuers would offer fewer perks, opponents of the longshot proposal say.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content