Drive results, recover revenue with zero-touch fraud resolution

The Payments Association

NOVEMBER 29, 2024

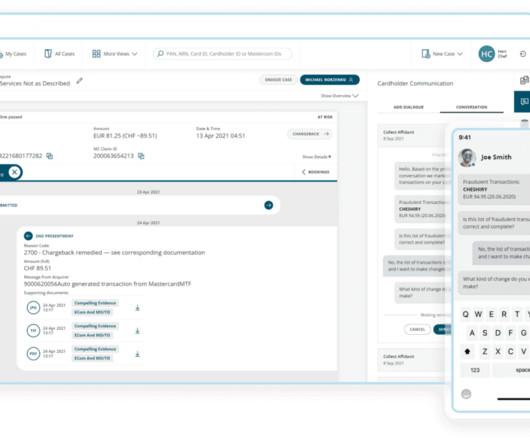

Managing fraud cases has been a top challenge for card issuers, according to recent studies. Rising operations and outsourcing costs and burgeoning fraud recovery caseloads make it especially challenging for issuers to meet chargeback deadlines and avoid cardholder write-offs.

Let's personalize your content