How card network rules help MoviePass disrupt the theater industry

Payments Source

AUGUST 28, 2017

A situation brewing in movie theaters that hinges on card network rules could have broad implications for the entertainment industry.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Card Network Rules Related Topics

Card Network Rules Related Topics

Payments Source

AUGUST 28, 2017

A situation brewing in movie theaters that hinges on card network rules could have broad implications for the entertainment industry.

EBizCharge

JUNE 27, 2025

Whether you’re a local shop, a service-based business, or an eCommerce brand, the fees you pay to accept credit card payments can eat into your profits. This guide will walk you through the basics of credit card surcharging in Canada, from legal background and card network rules to disclosure requirements and best practices.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Clearly Payments

NOVEMBER 18, 2024

Skills Required: Attention to detail, familiarity with card network rules, and proficiency in analyzing transaction data. Employee Training : Keep your team updated on card network rules and dispute resolution techniques. Monitor KPIs : Track metrics such as chargeback ratio, win rate, and resolution time.

EBizCharge

JUNE 19, 2025

So, if you’re a merchant trying to stay compliant or a consumer just trying to make sense of what you’re being charged – it’s worth understanding where these rules come from and what they mean. These networks set the terms for how their cards can be used, and if you want to accept their payments, you agree to play by their rules.

EBizCharge

JUNE 26, 2025

What to Include in a Credit Card Surcharge Notice When it comes to credit card surcharges, how you communicate the fee matters just as much as the fee itself. A clear and honest notice can prevent confusion, avoid legal issues, and build customer trust while helping you stay compliant with card network rules and state laws.

The Payments Association

FEBRUARY 3, 2025

is committed to ensuring its platform complies with the latest payment industry regulations and card network rules. Ensuring compliance with industry regulations : As a member of The Payments Association, avoided.io helps businesses navigate this complex landscape with ease.

EBizCharge

JUNE 26, 2025

From understanding the rules to selecting the right technology partner, every step matters in ensuring a seamless rollout. Research Surcharge Laws Understand federal guidelines and credit card network rules Check state laws to confirm surcharge legality in your location Consult legal counsel to ensure full compliance 2.

EBizCharge

JUNE 24, 2025

They’re treated differently under both state laws and card network rules. Legal complexity: You have to follow state laws and card network rules to stay compliant. Not allowed on debit or prepaid cards: Even if they’re run as credit, surcharging them violates rules.

EBizCharge

JUNE 25, 2025

If your business accepts credit cards, you’ve likely wondered whether you can pass processing fees on to your customers. Credit card surcharging lets you do just that but doing it the right way is essential. Between card network rules, signage requirements, and state regulations, there’s a lot to keep track of.

EBizCharge

JUNE 19, 2025

Check that debit cards aren’t being surcharged and that receipts reflect the fee properly. Card network rules can be updated. Even your own credit card processing fees might shift over time. Step 7: Monitor, Maintain, and Stay Compliant Once your system is up and running, your job isn’t done.

EBizCharge

JUNE 23, 2025

One option on the table is adding a credit card surcharge—a small extra fee to help cover your costs. But here’s the catch: surcharge rules are a patchwork of federal guidelines, state laws, and card network rules. And the card networks like Visa and Mastercard have their own rulebooks.

EBizCharge

JUNE 30, 2025

If you’re not careful, you could end up violating state laws or card network rules, which may result in fines or restrictions from your payment processing solution. As a trusted, top-rated payment processing solution, EBizCharge offers a fully compliant and easy-to-deploy no-fee payment processing model.

EBizCharge

JUNE 27, 2025

It’s worth noting that while many payment processing solutions now support no-cost credit card processing, not all do so in a compliant way. Businesses should be cautious about choosing a provider and ensure that the software they use follows current state regulations and card network rules.

Payments Source

JANUARY 22, 2019

The European Commission has fined Mastercard 570 million Euros, or about $648 million, over card network rules that prevented merchants from shopping for better terms at other banks in the EU.

EBizCharge

JUNE 19, 2025

Compliance and Legality Before you roll out a surcharge program, you need to understand the rules that govern how it must be implemented. You need to check state laws and card network rules. Visa, Mastercard and other networks require merchants to register their intent to surcharge.

EBizCharge

JUNE 17, 2025

At EBizCharge, we help businesses implement surcharge programs that reduce costs without violating card network rules or state laws. What Is a Credit Card Surcharge? It involves understanding card network rules, transparency with customers and setting up your systems to support the fee.

Stax

JULY 30, 2024

TL;DR A credit card surcharge program can be particularly beneficial for small businesses to offset the cost of accepting credit card payments. However, before implementing it, you must know all the state, federal, and card network rules surrounding it.

EBizCharge

JUNE 30, 2025

This upfront notice helps ensure transparency and keeps your business in compliance with card network rules and state regulations. Its purpose is to inform customers about any surcharge fees before they step inside and make a purchase. Placement: Signage must be clearly displayed at all customer entry points.

PYMNTS

OCTOBER 11, 2016

This is set to grow further as, in line with card network rules, no terminals without contactless technology can be sold or installed in Europe after 2018. is one of Europe’s most advanced markets for contactless payments with approximately 500,000 terminals currently active.

EBizCharge

JUNE 25, 2025

Legal and Card Network Rules Here’s where things get serious. For example, small business credit card surcharge rules in states like Connecticut and Massachusetts prohibit or heavily regulate this practice. Show the surcharge as a separate line item on receipts. The experience needs to be transparent.

EBizCharge

MAY 5, 2025

Compliance also involves adhering to card network rules and maintaining PCI compliance to protect sensitive card information and build customer trust. This setup automatically calculates and applies a surcharge at checkout, ensuring compliance with card network rules and state legislation.

EBizCharge

JUNE 18, 2025

Surcharges are only applicable to credit cards, meaning they can’t legally be applied to debit or prepaid card transactions. Why Card Network Rules Matter Each card brand has its own set of credit card surcharge rules.

PYMNTS

DECEMBER 29, 2016

In the meantime, and in line with best practice, we recommend that individuals closely monitor their payment card account statements. Payment card network rules generally state that cardholders are not responsible for such charges.”. If there are unauthorized charges, individuals should immediately notify their bank.

EBizCharge

JULY 1, 2025

Are you unsure whether your fees are compliant with state laws and card network rules? Choosing the Right Tool to Pass on Fees If you’re running a business and thinking about surcharging, it’s worth asking a few simple questions: Are you spending more time managing workarounds than running your business?

Payment Savvy

JULY 12, 2024

Complexity of Implementation: Ensuring compliance with various card network rules and state laws can be complicated. Legal Considerations for Convenience Fees Before implementing convenience fees , it’s crucial to understand the legal landscape and card network rules that govern these charges.

Payments Source

JULY 8, 2020

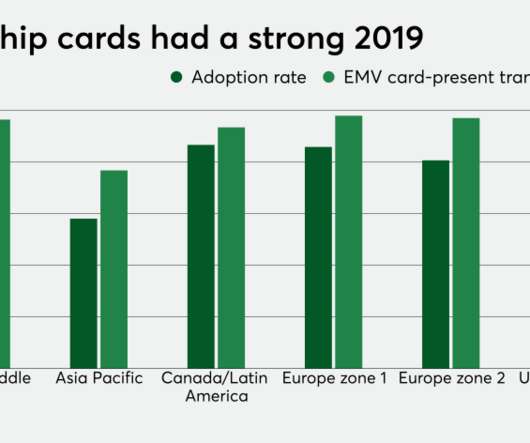

The role of EMVCo — which is often seen as an extension of the card brands that deals only with chip-based EMV plastic cards— has come into sharper focus.

Payments Source

SEPTEMBER 3, 2020

election could move the cannabis industry closer to the mainstream, but legal dispensaries will still have to deal with workarounds to accept card or mobile payments. The upcoming U.S.

Clearly Payments

SEPTEMBER 18, 2024

Collaboration with the Analyst: Advises on handling complex chargeback cases and navigating card network rules. Legal Advisor: The Protector In complex or high-value disputes, the legal advisor ensures compliance with regulations and assists in developing a robust defense during the representment process.

PYMNTS

APRIL 20, 2017

In the meantime, and in line with best practice, we recommend that individuals closely monitor their payment card account statements. Payment card network rules generally state that cardholders are not responsible for such charges.”. If there are unauthorized charges, individuals should immediately notify their bank.

Stax

SEPTEMBER 26, 2024

That said, you can’t just decide and impose credit card surcharges overnight. It requires stringent adherence to regulatory guidelines and card network rules, from surcharge caps to disclosure requirements. This is good news because it means you won’t have to inflate your base prices to cover payment processing fees.

Stax

JANUARY 15, 2024

Let’s now proceed to the final compliance that requires your attention: the card networks you engage with. Navigating Card Network Rules Credit card brands and financial institutions enforce PCI DSS compliance. They have unique rules, validation criteria, and compliance expectations you must adhere to.

Payments Source

MARCH 12, 2019

To successfully create new payment forms and uses, it’s critical to have a highly functioning team developing and promoting their ideas — something Colleen Taylor has fully embraced at Mastercard.

Payments Source

FEBRUARY 27, 2019

P2P transfer apps aren't just for splitting the rent — they can also be portals to a wider array of financial services, as Canada’s national Interac debit network plans to prove.

Stax

NOVEMBER 15, 2023

This strategy offers transparency and allows businesses to maintain their profit margins while offsetting the cost of processing card payments. It’s important to note that the legality of surcharging varies by location and is subject to regulations and card network rules.

Payments Source

JUNE 17, 2019

Payments Canada is proposing to allow delayed transaction authorization to enable debit cards to be used in open-loop transit — and the change could affect far more than commuters.

Payments Source

NOVEMBER 3, 2017

In the U.S., Visa Direct has emerged as one of the few go-to tools for fast payments in a market that is overdue for such options. The product's true test begins now, as Visa launches it in Europe, where faster payments options are far more plentiful.

Payments Source

JANUARY 14, 2020

The specific impetus for the Federal Trade Commission's inquiry into Visa and Mastercard's debit transaction routing processes is not entirely clear, but it likely stems from the effect that advanced payments technology has had on Durbin amendment compliance.

Payments Source

DECEMBER 14, 2017

As Mastercard, Discover and American Express all plan to drop signature authentication at the point of sale, Visa is largely mum on the topic. But does it really need to weigh in?

Payments Source

APRIL 6, 2018

MoviePass has purchased Moviefone, the movie listing and information service, in a deal that gives momentum to a business that owes its success to honor-all-cards rules.

Payments Source

JANUARY 8, 2018

Visa did not attribute its shutdown to the use of bitcoin, but the incident is a further reminder — as if one was needed — that cryptocurrencies' volatility extends beyond their dramatic pricing swings.

Payments Source

JANUARY 26, 2018

MoviePass has pulled its participation from 10 AMC movie theaters following disagreement over the theaters’ support of MoviePass’ $9.95 monthly movie subscription model, which uses a Mastercard to guarantee payment through its app.

Payments Source

NOVEMBER 8, 2019

Two Mastercard issuers have enabled Mastercard’s True Name feature for customers who opt to use their preferred name on credit, debit and prepaid cards instead of their legal name, to support gender inclusion.

Payments Source

JULY 24, 2018

Under its new chargeback rules, Visa retired one of the chargeback codes that merchants almost always lost — "transaction not recognized," formerly listed as Chargeback Reason Code 75.

Payments Source

OCTOBER 18, 2018

American Express Co.’s s quest to be accepted everywhere from the corner bodega to the nail salon down the street is paying off.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content