Concerns Arise About Flawed Liability Regime as EU Council Progresses in Upgrading Payment Framework

The Fintech Times

JUNE 18, 2025

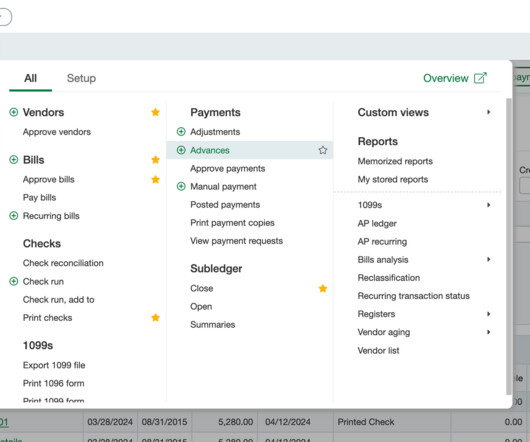

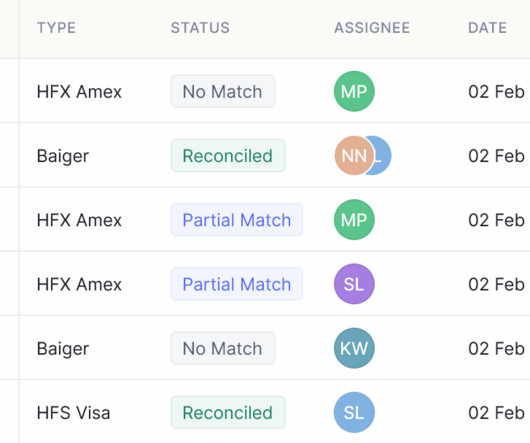

Should the new rules be put into place, payment service providers would have to share fraud-related information with each other and implement a system where IBAN numbers can be checked against a corresponding bank account name before transferring money to it.

Let's personalize your content