Credit Card Payment Integration: How to Integrate Payments into Your Website and Point of Sale

Stax

MARCH 4, 2025

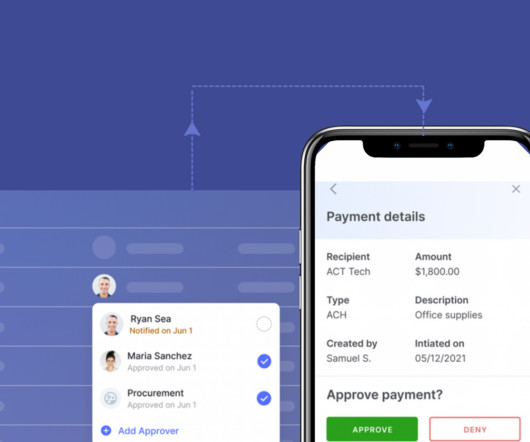

TL;DR Online payments rely on API or hosted gateways with encryption and fraud detection, while in-store transactions require POS hardware with EMV chip technology and NFC capabilities. The issuing bank verifies whether the customer has enough funds in their account to complete the transaction. Need to integrate payments?

Let's personalize your content