AI in Finance: Freeing Managers from Routine Tasks to Drive Business Growth

Fintech News

JANUARY 13, 2025

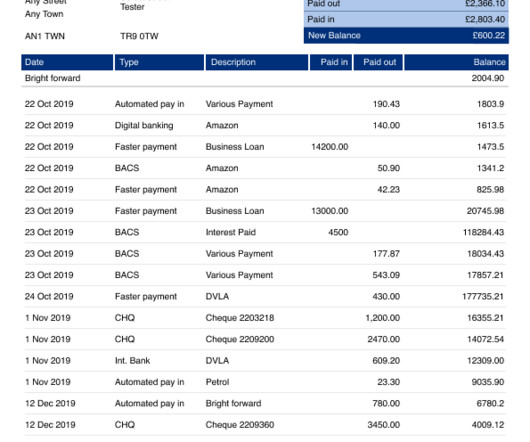

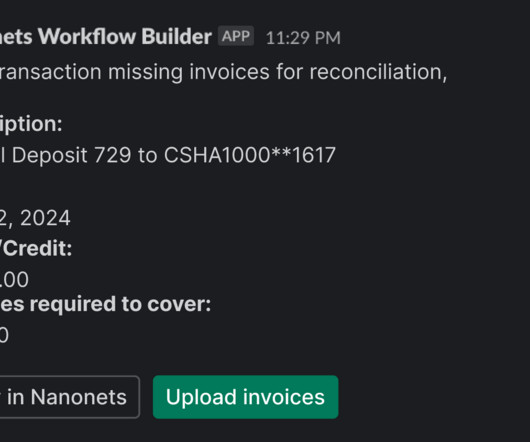

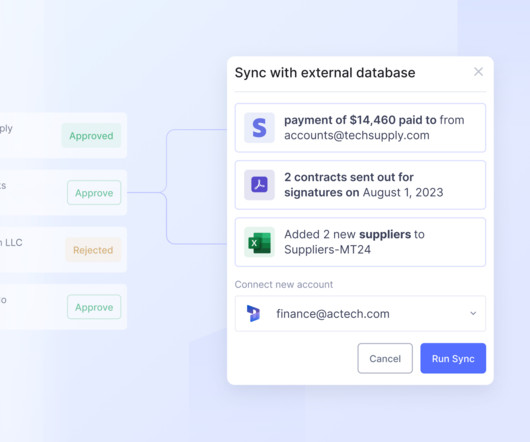

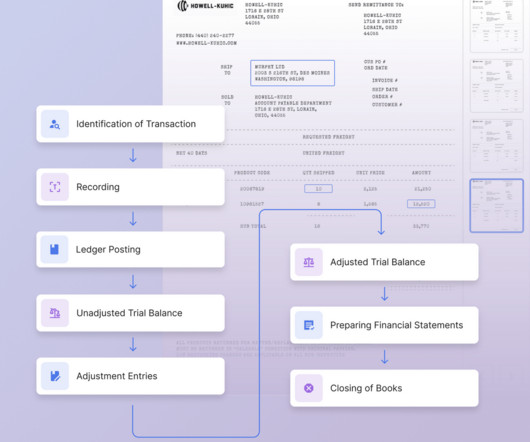

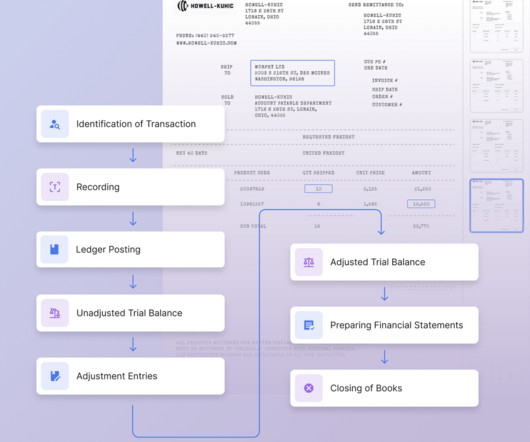

Effective expense management, however, depends on how well a company captures and processes information, approves transactions, ensures accurate financial accounting, and uploads correct payment data. Fraud detection is yet another area where AI can be a true ally. AI-powered spend management tools, like Summit , excel here.

Let's personalize your content