How FedNow may affect businesses

Payments Dive

JULY 24, 2023

The launch of the instant payments system FedNow last week has the potential to change how businesses manage cash flow and corporate processes. Here are six ways that could play out.

Payments Dive

JULY 24, 2023

The launch of the instant payments system FedNow last week has the potential to change how businesses manage cash flow and corporate processes. Here are six ways that could play out.

PCI Security Standards

JULY 25, 2023

While not new to the Council, current Board of Advisor member MagicCube is now a new Principal Participating Organization (PPO) at the PCI Security Standards Council! In this special spotlight edition of our PCI Perspectives Blog, MagicCube’s co-founders Nancy Zayed, CTO and Sam Shawki, CEO introduce us to their company and how they are helping to shape the future of payment security.

Agile Payments

JULY 23, 2023

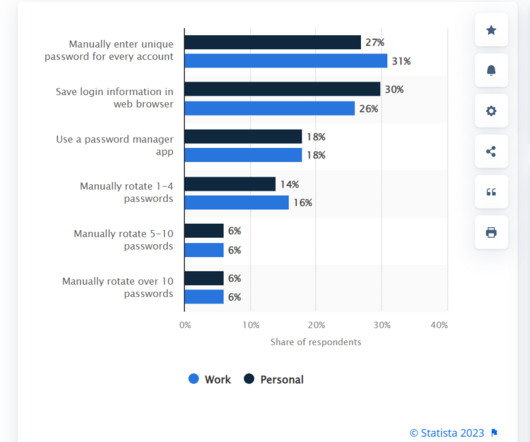

How to Keep Your Passwords Safe on the Web Studies show that 52% of people in the world have at least five passwords. From that figure, 78% of people forget their login information. Due to this, they often do a reset to access their online accounts. One of the easiest ways to remember your passwords is to save them in your browsers. You can save them in one click or even create random passwords.

National Processing

JULY 25, 2023

The good news is that you don’t need any additional hardware or software to accept digital wallet payments online. But you do need a payment gateway, payment processing service, and an ecommerce platform that are compatible with digital wallets. The post Digital Wallets and the Future of eCommerce: What Merchants Should Know Before Accepting Digital Wallet Payments appeared first on National Processing.

Advertisement

Ready to boost your game and stand out in the competitive world of merchant services sales? Discover 6 innovative strategies that will help you rise above the crowd, from leveraging tech trends and perfecting referral programs to harnessing the power of testimonials and pop-up events. Learn how educating clients can turn you into a trusted advisor and uncover the secrets of building community ties that cement your reputation as a market leader.

Payments Dive

JULY 26, 2023

“It’s not a great customer experience,” Visa CEO Ryan McInerney said of merchant surcharges, while speaking on an earnings webcast Tuesday.

The Paypers

JULY 24, 2023

UK-based credit provider TotallyMoney has chosen data intelligence platform Bud Financial (Bud) to enable customers to manage finances with the support of AI.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Nomentia

JULY 28, 2023

We recently interviewed treasury expert Patrick Kunz, who’s been working in treasury all his life. As he mentioned himself during the webinar , “Treasury is basically all I know.

Payments Dive

JULY 25, 2023

The card issuer paid the fine for failing to properly monitor a third-party affiliate and in connection with its courting of small business clients, the agency said.

The Paypers

JULY 26, 2023

Global financial super app Revolut has announced that it is now offering accounts to non-citizens lawfully in the US who do not have an SSN or ITIN.

M2P Fintech

JULY 28, 2023

Debit cards are pivotal to a bank’s digital payment mix. With minimal credit and regulatory risks involved, they are safe digital payment facilitators that deliver convenient transactions, freedom from debt, and rewards. Banks leverage debit cards for higher customer acquisition, retention, and loyalty while diversifying revenue streams through transaction fees.

Speaker: Jason Cottrell and Brian Walker

The era of all-in-one platforms is over. Now, retail success depends on integrating a blend of diverse technologies to thrive. As customers and stakeholders expect agility and innovation, how can you meet these expectations efficiently without stumbling into complexity? Explore a customer-centric approach to navigating digital transformation in retail.

Nanonets

JULY 28, 2023

The modern business landscape is characterized by an overwhelming amount of information and documents that organizations must contend with. The global production, capture, copying, and consumption of data from various documents has been experiencing exponential growth. In 2020, the total data generated reached an estimated 64.2 zettabytes. Projections suggest that this trend will continue, with global data creation projected to exceed 180 zettabytes by 2025.

Payments Dive

JULY 27, 2023

The deal, Upgrade’s first acquisition, more than doubles the neobank’s customer base by adding 3.3 million users to its existing 2.5 million, CEO Renaud Laplanche said.

Axway

JULY 27, 2023

Axway is constantly involved in the digital education of students and especially of women, who are often less represented in the tech industry. But in our different office locations, some actions are taking place.

ACI Worldwide Blog

JULY 26, 2023

As payments continues to play a starring role in competitive sales strategies, merchants are increasingly turning to payments orchestration to help them build better end-to-end customer experiences and meet increasingly demanding operational KPIs. The post 7 Ways Payments Orchestration is a Game Changer appeared first on ACI Worldwide.

Speaker: David Nisbet, Everett Zufelt, and Michaela Weber

Once upon a time, in the vast realm of online commerce, there lived a humble checkout button overlooked by many. Yet, within its humble click lay the power to transform a mere visitor into a loyal customer. 🧐 💡 Getting checkout right can mark the difference between a successful sale and an abandoned cart, yet many businesses fail to make payments a part of their commerce strategy even when it has a direct impact on revenue.

Nomentia

JULY 26, 2023

It’s not a secret: many industries are facing a massive transformation – the world is more globalized than ever; manufacturing of goods can happen in remote places, your business can rely heavily on the supply chain, and even your workforce may be scattered all over the globe (possibly working from home). These are just a few examples of why businesses also need to change.

Payments Dive

JULY 27, 2023

“Latin America has been a standout grower in recent quarters, and we believe it can remain so for the long term,” Fiserv CEO Frank Bisignano said Wednesday during an earnings call.

PayXpert

JULY 26, 2023

The focus tends to be on large retailers when discussing payment offers and solutions. Multinational companies and businesses with a wide range and portfolio of customers have an annual turnover of millions of euros and, consequently, must offer and provide the widest variety of payment possibilities and options to their already large number of customers.

ACI Worldwide Blog

JULY 26, 2023

As payments continues to play a starring role in competitive sales strategies, merchants are increasingly turning to payments orchestration to help them build better end-to-end customer experiences and meet increasingly demanding operational KPIs. The post 7 Ways Payments Orchestration is a Game Changer appeared first on ACI Worldwide.

Advertisement

Maximize success as an independent sales agent with a supportive payment processor partner. This article reveals the challenges agents face with uncooperative processors, like slow responses and lack of support, leading to missed opportunities. Discover how a supportive partnership can transform your success, offering extensive training, marketing materials, and ongoing support.

PayHawk

JULY 26, 2023

Whether it’s your first time hearing about PayHawk or perhaps you have heard of us and you’re in the market for a merchant service provider to deal with the payment processing process – you’ve come to the right place. Today, we’ll be comparing ourselves (PayHawk) to some of the biggest dogs in the payment processing industry. ** Before we dive in, you absolutely must know that PayHawk operates on a variable fee rate, and does not offer one static price, but on the same side of the coin,

Payments Dive

JULY 28, 2023

“It's time to question whether this traditional approach to paying employees is still the most efficient and equitable,” writes one earned wage access CEO.

Nanonets

JULY 26, 2023

Extracting relevant and accurate financial data from financial and business documents is critical for effective decision-making, financial analysis, and integrity, as well as regulatory compliance. However, the process of extracting financial data can be challenging, time-consuming, and prone to errors when relying on manual processes or outdated methods.

Currencycloud

JULY 25, 2023

The American financial system is unique in its scale and complexity: the sheer size of the country and the autonomy given to individual states have left it with a web of regulations and deeply entrenched banks.

Speaker: David Azoulay, Marc Stracuzza, Román Tejada, and Guest Speaker Sucharita Kodali

Imagine a retail landscape where every interaction is personalized, every decision informed, and every opportunity maximized 🤔✨ Join us for an exploratory journey into the heart of AI-driven retail innovation. We’ll unveil the transformative potential of AI and data analytics in shaping the future of omnichannel personalization and e-commerce.

PayHawk

JULY 26, 2023

Widely recognized and trusted brand PayPal is one of the most well-known and trusted payment processors in the world. This can give small businesses added credibility and trust with their customers. Easy to set up and use PayPal is easy to set up and use, even for those without much technical experience. This makes it a good option for small businesses that may not have the resources to invest in a more complex payment processor.

Payments Dive

JULY 26, 2023

Mastercard teamed with Billtrust to begin offering the new tool, which will automate the process of sending and accepting virtual cards for business-to-business payments.

Open Bank Project Blog

JULY 25, 2023

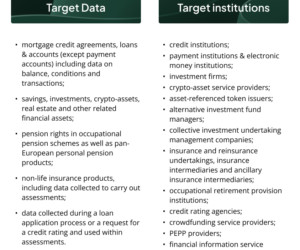

On June 28, the European Commission (EC) published the much-awaited proposals for modernising the EU payments market and financial sector. The proposals include the revised Payment Services Directive (PSD3) combined with a new EU Payments Regulation (PSR) , as well as a framework for accessing financial data beyond payments ( FIDA ).

Nanonets

JULY 25, 2023

What is financial data analysis? Gartner defines financial analysis as the process that provides “insight into the financial performance of an organization.” It falls under the umbrella of business intelligence (BI) and enterprise performance management (EPM), utilizing technologies and strategies to analyze data and generate reports.

Advertisement

Explore how integrated payment strategies impact investor and buyer evaluations. Payments are more than a feature — they’re a key to long-term success and market differentiation. They help SaaS companies offer seamless user experiences and efficient operations. Investors and strategic buyers assess these integrated payment strategies as a measure of a company's growth potential and sustainability.

BlueSnap

JULY 24, 2023

Everyone can agree that managing a single invoice from quote-to-cash shouldn’t take 11 hours, nor should 15 different people be involved to complete the process. But our Progressing Payments Report found that this is what goes into manual invoice processing. The post Improve Manual Processes with AR Automation, Improve Employee Retention appeared first on BlueSnap.

Payments Dive

JULY 27, 2023

While Mastercard participates in real-time payment systems in other countries, it’s holding back for now on the new U.S. instant payments network.

Payment Savvy

JULY 23, 2023

The Federal Firearms License (FFL) is a cornerstone for businesses in the flourishing firearms industry. In 2022 alone, a staggering 16.4 million firearms were sold across the United States, underscoring the industry’s robust growth. Furthermore, the U.S. firearm industry’s contribution to the economy is substantial, injecting 28 billion dollars into the economy.

Nanonets

JULY 25, 2023

Business today face the challenge of managing large volumes of financial data, producing accurate and timely reports so as to draw actionable insights from them. This is where financial reporting automation comes into play. By harnessing the power of technology and automation, businesses can streamline their financial reporting processes, improve efficiency, and make more informed decisions.

Speaker: Jennifer Wright, Michael Scholz, Jasmin Guthmann, and Scott Canney

Digital transformation in retail is so much more than new technology. You need to get your whole organization, from entry-level workers to executives, on board with the new tech, new skills, and culture changes that digital transformation brings. Leading this mindset shift can be a daunting task… but that’s where this webinar comes in! Join our panel of experts as they guide you through the challenges of digital transformation, preparing you to avoid common mistakes and make the most of incredib

Let's personalize your content