Top regulatory priorities for the payments sector

The Payments Association

FEBRUARY 14, 2025

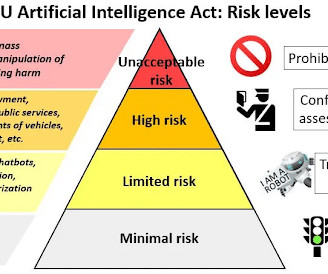

Regulatory compliance : Staying compliant with open banking regulations is crucial. Firms must meet all regulatory requirements, including data protection, consent management, and security standards. In 2025, regulatory changes will be as pivotal as technological advancements.

Let's personalize your content