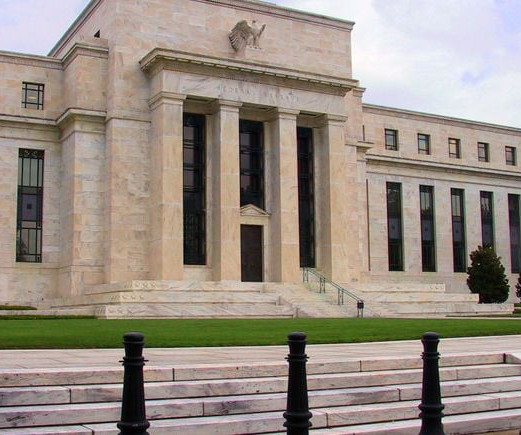

FedNow to launch by mid-2023, Fed official says

Payments Dive

AUGUST 19, 2022

The federal government’s new real-time payments system should be ready for use by the middle of next year, Fed Governor Michelle Bowman said in a speech this week.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Fed Related Topics

Fed Related Topics

Payments Dive

AUGUST 19, 2022

The federal government’s new real-time payments system should be ready for use by the middle of next year, Fed Governor Michelle Bowman said in a speech this week.

Payments Dive

APRIL 25, 2024

About 700 financial institutions have connected to the Fed’s instant payment network since last July, with at least 1,000 more in the pipeline, a FedNow official said this week.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Tom Groenfeldt

FEBRUARY 4, 2019

If banks are worried about big tech players getting into payments, they have a right to be -- Google and Amazon, among others, would like access to Fed faster payments.

Payments Dive

SEPTEMBER 13, 2023

Fed officials are on a campaign to increase adoption of the new instant payments system, noting it may have implications for other Fed services.

Tom Groenfeldt

JANUARY 30, 2019

Fed payment experts think the central bank should build and operate a real-time payments network to provide competition to the TCH network operated by the largest banks.

Payments Dive

MAY 22, 2025

Consumers keep using cash, but credit cards are king, the Federal Reserve Bank of Atlanta documented in its annual payment method survey.

Payments Dive

OCTOBER 20, 2023

The Fed hasn’t changed a debit card fee cap since it was put in place in 2011, but it's planning to take up the issue at a meeting next week.

Payments Dive

MARCH 20, 2024

New research from the Philadelphia and Boston Feds finds that consumers are cycling through low APR credit card offers.

Payments Dive

NOVEMBER 21, 2023

As consumers have leaned on credit cards more in recent months, applications for credit card limit extensions also rose, the New York Fed said Monday.

Payments Dive

JULY 14, 2023

Cleveland Fed President Loretta Mester in a speech this week spelled out tools the new instant payments system will have for thwarting fraud.

Payments Dive

MAY 23, 2023

but cash demand remains stable, a Fed report showed. Credit cards were the most used payment method last year in the U.S.,

Payments Dive

MAY 15, 2025

credit card balances declined and credit card aggregate limits inched up from the prior quarter, the New York Fed said. Meanwhile, U.S.

Payments Dive

FEBRUARY 27, 2024

This Fed official makes a strong case, but digital doubts may remain. Can the dollar’s reign as the world’s reserve currency persist?

PYMNTS

APRIL 10, 2020

As reported, the Fed is expanding its “Main Street” lending efforts for smaller firms that have staff up to 10,000 individuals; the expanded Main Street focus will provide an added $600 billion in loans and offers $75 billion slated to come from the Treasury Department. The Fed package, of course, comes on the heels of the $2.2

PYMNTS

SEPTEMBER 25, 2020

Cleveland Federal Reserve President Loretta Mester said in a speech this week that a digital dollar could conceivably be a form of money transfer that would enable the Fed to disburse money to all individuals in America. The Fed, of course, is hardly alone in mulling digital fiat currencies.

Payments Dive

JULY 20, 2022

A federal government report released this week takes aim at the problem of fraudulent public benefit payments, which mushroomed to $281 billion for fiscal year 2021.

Bank Automation

MAY 2, 2025

The decision sounds like the Fed had predetermined it was going to approve the transaction and […] The post Senator Warren urges Fed to reconsider Capital One deal for Discover appeared first on Bank Automation News.

Payments Dive

NOVEMBER 22, 2024

The regional Fed bank, which has purview for the proposed merger, demanded more information from the bank as it considers whether to approve the deal.

Payments Dive

APRIL 14, 2025

Some House Financial Services Committee members are pressuring the Federal Reserve to reverse a proposal to lower the debit card fees that banks can charge.

PYMNTS

AUGUST 14, 2020

In a speech delivered by webcast at the Federal Reserve Board and Federal Reserve Bank of San Francisco’s Innovation Office Hours, Fed Governor Lael Brainard said that the Federal Reserve Bank of Boston is working with researchers at MIT to “build and test a hypothetical digital currency oriented to central bank uses.”.

Payments Dive

APRIL 22, 2024

The Federal Reserve is stressing the importance of fintechs and core providers for the future expansion of its new instant payments system FedNow.

Payments Dive

NOVEMBER 5, 2024

“It's going to be up to us to move instant payments from being novel to being normal,” Federal Reserve Financial Services’ chief payments executive told attendees at a major industry conference last week.

Payments Dive

MAY 6, 2025

The Democratic lawmakers blasted the central bank’s “analysis, or lack thereof,” arguing the Fed “parroted assertions made by Capital One.”

Payments Source

AUGUST 14, 2019

Were the Fed to develop its own payments platform, it would be expensive, duplicative, inefficient, and curtail development of real-time services, argues the National Taxpayers Union's Thomas Aiello.

Payments Dive

APRIL 24, 2023

Card, ACH and check payment values climbed from 2018 to 2021, as cash was left behind, according to the Federal Reserve’s noncash payments study.

The Fintech Times

FEBRUARY 6, 2025

Neuner points out that while Wyoming and the OCC did issue three charters previously, none of them have been able to gain access to the Fed payment system. Ive always believed that the key to making crypto usable in payments and mainstream finance is a digital asset bank with native connections to the existing financial system.

Payments Dive

NOVEMBER 27, 2024

Consumers’ credit card delinquencies have risen this year, along with their balances, according to an annual Federal Reserve Board report.

Payments Dive

SEPTEMBER 30, 2024

While most U.S. households have a bank account, just under half use a nonbank payment service, Kansas City Federal Reserve Bank research says.

Payments Dive

OCTOBER 4, 2022

In a 6-1 vote, the Federal Reserve finalized a debit card processing rule that underscores a requirement that multiple card networks be available for routing transactions, including online.

PYMNTS

MARCH 22, 2020

The Fed doesn’t currently think that the virus will be worsened by the transmission and trading-hands of dollars, Joey Lee, spokesperson for the Federal Reserve Bank of Philadelphia, said, pointing to recent Centers for Disease Control and Prevention (CDC) findings. In recent weeks, as the virus has spread rapidly across the U.S.

PYMNTS

OCTOBER 9, 2020

Fed Governor Lael Brainard said in August that the Federal Reserve Bank of Boston is working with researchers at MIT to “build and test a hypothetical digital currency oriented to central bank uses.” The Fed also launched an instant payment initiative in August.

Finextra

JANUARY 14, 2025

Stablecoins are going mainstream and could grow to rival credit and debit cards, predicts a payments expert at the Atlanta Fed.

PYMNTS

JUNE 2, 2020

The Atlanta Fed said the next GDPNow update will be on Thursday (June 4). The Atlanta Fed cautioned, “In particular, it does not capture the impact of COVID-19 beyond its impact on GDP source data and relevant economic reports that have already been released. trillion to the U.S.

PYMNTS

MARCH 23, 2020

The Fed would be in control of the digital wallets. In addition, member banks of the Fed can have a “pass-through digital dollar wallet” per the draft bills, as cited by the outlet. Recipients of payments would get a “pro-rata share of a pooled reserve balance” that the member keeps.

PYMNTS

OCTOBER 19, 2020

The Fed chief made his comments as part of a panel discussion on digital currencies hosted by the International Monetary Fund (IMF). The Fed chief, noting that the U.S. It comes on the heels of an IMF report that raises concerns about growing momentum toward central bank-issued digital currencies (CBDCs).

Payments Dive

APRIL 20, 2023

The Federal Reserve plans to discontinue its cross-border ACH payments service to Europe and Canada later this year, Fed officials reiterated at a conference this week.

Payments Dive

NOVEMBER 14, 2023

The new hire is tasked with boosting adoption of The Clearing House’s RTP real-time payments system, as the new rival Federal Reserve FedNow system seeks to attract clients.

Payments Dive

OCTOBER 1, 2024

The Federal Reserve’s interest rate reduction may give the company leeway to offer more consumers 0% interest or a lower APR, Affirm CFO Michael Linford said this week.

Payments Dive

AUGUST 26, 2024

Gen Z and millennials were the age groups most likely to use loans and credit cards to respond to higher prices, a Federal Reserve research report said.

Payments Dive

MAY 12, 2022

While first-quarter consumer credit card debt rose relative to the same period last year, it dropped compared to the fourth quarter. Meanwhile, consumers' outlook on the availability of credit deteriorated.

Payments Dive

SEPTEMBER 18, 2024

The Federal Reserve’s proposal to extend the operating hours of two interbank payments systems has been welcomed by large banks, but panned by many small financial institutions.

Payments Dive

SEPTEMBER 8, 2022

Here are 10 takeaways from the Fed's new head of supervision, on everything from payments to crypto to FedNow.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content