Real-Time Payments Will Get Real In The U.S. In 2019

Tom Groenfeldt

MARCH 5, 2019

Real-time payments aren't just faster, they make demands on bank infrastructure and fraud detection.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Tom Groenfeldt

MARCH 5, 2019

Real-time payments aren't just faster, they make demands on bank infrastructure and fraud detection.

The Payments Association

NOVEMBER 21, 2024

The latest addition to this network is Forter, a global leader in AI-powered fraud prevention, who joins Paydock in transforming fraud detection and prevention for online businesses. By automating fraud detection, businesses can eliminate manual reviews, accelerating fulfilment and providing a smooth customer experience.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Fintech Finance

APRIL 24, 2025

The results suggest larger transaction limits are helping to boost instant payment demand. Nearly half (47%) of US banks now experience overwhelming corporate demand, more than triple the 16% from 2024. The report also reveals significant concerns around fraud. Over one in ten (12%) expect that surge to top 50%.

Clearly Payments

OCTOBER 30, 2024

Selling products and services internationally means facing new challenges, especially regarding payment processing, regulatory requirements, currency exchanges, and fraud prevention. To successfully meet international demand, Canadian merchants need a system capable of handling these complexities with reliability, speed, and low costs.

The Payments Association

JANUARY 21, 2025

This report provides a comprehensive analysis of the key trends defining the payments sector in 2024, highlighting the opportunities for strategic growth, as well as the challenges posed by regulatory pressures, financial crime, and evolving infrastructure demands.

Fintech Finance

NOVEMBER 14, 2024

The survey reveals that 81% of merchants anticipate a surge in digital wallet usage, while 69% expect Open Banking and instant bank transfers to gain popularity as consumer demand for convenient, secure payment options continues to grow.

Fintech News

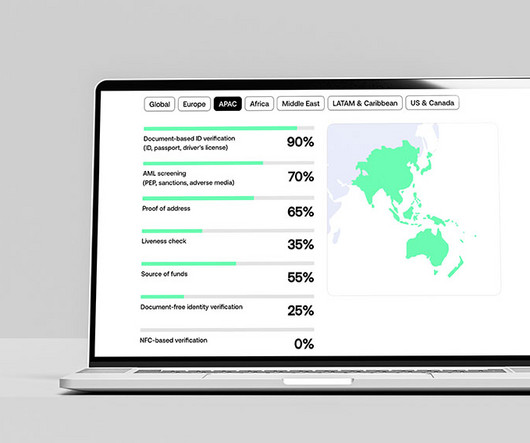

MARCH 24, 2025

According to a new report by Sumsub, crypto fraud rates declined by a remarkable 23% between 2023 and 2024, positioning APAC as a leader in combating crypto fraud. This comes as manual and in-house verification struggle to meet the crypto industry’s fast-paced demands. in 2023 to 2% in 2024. in verification times.

The Payments Association

JANUARY 3, 2025

A roundtable discussion among merchants addressing the evolving challenges of fraud in their operations across various sectors. It highlights the necessity of advanced fraud detection and greater industry collaboration. Improving regulations, using technology for detection, and fostering industry-wide cooperation.

Fintech Finance

DECEMBER 11, 2024

In the first half of 2025, Swift plans to roll out a sandbox with synthetic data to prototype learning from historic fraud, working with 12 global financial institutions, with Google Cloud as a strategic partner. A collaborative approach to fraud modeling offers significant advantages over traditional methods in combating financial crimes.

Fintech Finance

DECEMBER 17, 2024

At the Digital Future Forum, Visa’s experts highlighted key trends set to redefine Vietnam’s payment landscape by 2025: Real-Time and Account-to-Account Payments: Consumers and businesses demand faster, more efficient payments. The Digital Future Forum highlighted the evolving preferences and behaviors of Vietnamese consumers.

The Payments Association

JUNE 9, 2025

Filip Berlikowski CTO, Payall "RT2’s real-time capabilities and ISO 20022 structured data will transform UK payments—enabling immediate fraud detection, reducing false positives, and turning compliance into a competitive edge. Why is it important? Democratised access will foster fintech-bank collaboration, driving innovation.

The Fintech Times

NOVEMBER 16, 2024

Through a recent survey, payabl found that 81 per cent of merchants expect to see growth in digital wallet usage, while 69 per cent expect open banking and instant bank transfers to gain popularity as consumer demand for convenient, secure payment options continues to grow.

Fintech News

DECEMBER 4, 2024

The partnership also enables Grab to meet the increasing demand for its services, ensuring a seamless customer experience even during peak periods, such as holiday sales spikes. These models support innovations like tailored restaurant recommendations, loyalty rewards, and fraud prevention for its digital banks.

The Payments Association

MARCH 19, 2025

Security & compliance risks: Meeting growing AML, fraud prevention, and regulatory demands is difficult with rigid, outdated infrastructure. Future-proof payment and banking infrastructure by implementing cloud-native, AI-driven automation, and Open API solutions that streamline payments and improve fraud detection.

The Fintech Times

FEBRUARY 11, 2025

Nigeria leads as a top remittance receiver, followed by Kenya and Cameroon, highlighting the growing demand for reliable cross-border money transfer solutions across various corridors on the continent. Flutterwave’s influence does not stop in Europe though. In 2024, Send App successfully expanded services to 49 US states.

The Payments Association

APRIL 8, 2025

A roundtable discussion among merchants addressing the evolving challenges of fraud in their operations across various sectors. It highlights the necessity of advanced fraud detection and greater industry collaboration. Improving regulations, using technology for detection, and fostering industry-wide cooperation.

Clearly Payments

DECEMBER 19, 2024

This growth is driven by increased consumer demand, lower transaction fees, and enhanced cross-border capabilities. 90% of Consumers Expect a Seamless Omnichannel Payment Experience Todays customers demand consistency across all touchpoints. Common types include card-not-present fraud, phishing attacks, and identity theft.

VISTA InfoSec

JULY 19, 2024

As fraudsters are continuously finding new ways to strike, we’re continuously finding new ways to prevent them with controls such as encryption, multi-factor authentication, fraud detection software, etc. Why PCBs matter in cybersecurity When looking for ways to protect our devices against fraud, we always turn to external defenses.

Stax

APRIL 3, 2025

Like most business owners, your instincts tell you to hop on the bandwagon and launch an online store for your business. But launching your eCommerce store is just half the equationaccepting payments efficiently and effectively is a whole different ball game. Its like a duck floating on water.

Clearly Payments

NOVEMBER 6, 2024

The payment processing market in the United States has demonstrated robust growth, driven by rising consumer demand for digital payments, advancements in financial technology, and the expansion of e-commerce. They can also offer additional services like fraud detection, chargeback management , and analytics.

The Payments Association

JANUARY 8, 2025

Businesses need to stay ahead by adapting to new technologies and delivering the seamless, secure experiences customers now demand. AI is already essential for fraud detection, offering real-time monitoring to prevent issues. It also supports regulatory compliance by automating checks.

The Payments Association

JUNE 11, 2025

Consequently, the cost of fraud prevention now reaches $4.61 for every $1 of actual fraud incurred, intensifying the trade-off between safeguarding the platform and maintaining scale. Static, manual-heavy models are no longer viable. Generative AI and biometrics, including behavioural biometrics, offer massive potential.

The Payments Association

JUNE 16, 2025

Craig Savage Founder & CEO, FERO "There is growing consumer demand for secure payment solutions such as Pay by Bank, and merchants should be aware of this trend to remain ahead of the curve. Recent market data shows this demand is reaching a tipping point across Europe.

Paystand

JULY 2, 2025

Financial institutions are leveraging fraud detection, credit decisions, and risk management powered by large language models and machine learning. An aging workforce, evolving regulatory demands, and the complexity of modern finance have created a gap that universities and training programs struggle to fill.

The Payments Association

JUNE 16, 2025

Simultaneously, it would entail trade-offs in security, user experience, and operational design that demand careful scrutiny across the industry. The findings show that it’s technically possible, but with significant challenges surrounding fraud detection, data sharing, and usability.

The Payments Association

FEBRUARY 10, 2025

Businesses must proactively assess fraud risks, implement adequate procedures, leverage technology for fraud detection, and foster a culture of compliance to avoid regulatory penalties. While the law primarily targets large firms, smaller businesses may also face scrutiny depending on their activities. More than 250 employees.

The Payments Association

JANUARY 13, 2025

Stronger fraud detection and better industry collaboration are needed to protect consumers The Payment Systems Regulator’s (PSR) findings in its December’s Unmasking how fraudsters target UK consumers in the digital age report reveal a stark picture of the growing threat posed by authorised push payment (APP) scams.

Clearly Payments

JANUARY 21, 2025

Stronger Security: Advanced encryption, tokenization , and fraud detection protect sensitive data and bolster public trust. The scalable system handled peak-season demand efficiently, improving visitor satisfaction and enabling the agency to allocate resources more effectively based on data insights.

The Payments Association

APRIL 7, 2025

The findings of the Financial Crime 360 survey, focusing on the challenges, prevalent fraud types, and strategic responses across various sectors. Continued investment in innovative fraud detection technologies and adaptive regulatory frameworks is essential to stay ahead of evolving financial crime threats. Why is it important?

PYMNTS

JUNE 11, 2020

Fraud detection software platform NS8 has closed a Series A funding round for $123 million, led by Lightspeed Venture Partners , a press release states. The software utilizes real-time data analytics and real-time scoring to help merchants snuff out fraud and deliver seamless transactions, the press release says.

Finextra

JUNE 30, 2025

On the risk and operations side, common uses include fraud detection, anti-money-laundering pattern detection, credit risk scoring and trading optimization. finance leaders cite fraud and risk management as areas in which they use AI. finance leaders cite fraud and risk management as areas in which they use AI.

The Fintech Times

JUNE 3, 2025

The annual State of Payments report expanded this year to survey a total of 1,000 small to medium-sized businesses (SMBs) along with 3,000 consumers across the US and UK, finding that consumer demand for flexible, real-time, and digitally integrated payment experiences is increasing.

The Payments Association

JUNE 16, 2025

Benefits and challenges of AI and embedded finance While it is true that AI investments have led to enhanced fraud detection, risk management, and the hyper-personalisation of customer offerings. Without the use cases, is AI anything more than smart automation? And that, indeed, is not new.

Fintech Finance

FEBRUARY 17, 2025

As the fintech industry continues to grow and evolve, so do the demands for regulatory compliance. Fintech compliance is an increasingly important aspect of the financial industry. The new tool reduces ‘false positives’ by an average of 50%, while enhancing customer on-boarding experience.

Fintech Finance

OCTOBER 23, 2024

Compliance with sanction screening, anti-money laundering (AML) and fraud detection requirements, including Verification of Payee check, was identified as the top concern. Banks show similar alignment in their approach to sanction screening and fraud detection.

Finovate

FEBRUARY 5, 2025

Worldpay plans to acquire AI-driven fraud detection company Ravelin. The acquisition will help Worldpay enhance its e-commerce offerings by adding fraud prevention technology and improve business clients’ authorization rates. Financial terms of the deal were not disclosed.

Fintech Finance

MAY 1, 2025

It delivers unified and secure money movement experiences that can be embedded across a variety of customer channels, helping institutions meet digital demands quickly and efficiently. The post FIS Harmonizes Payments With Launch of Unified Money Movement Hub appeared first on FF News | Fintech Finance.

PYMNTS

JULY 14, 2020

Alert rates have stayed flat and fraud detection has gone unchanged. This highlights an opportunity to increase operational efficiencies and meet customer demands.”. Alert rates have stayed flat and fraud detection has gone unchanged. This is where the power of advanced machine learning really comes into play.

Fi911

DECEMBER 19, 2023

The rapid evolution of technology and the escalating demand for online banking services have made machine learning (ML) an invaluable asset in preemptively tackling fraud risks. The Escalating Threat of Financial Fraud Financial crimes are on an upward trajectory. The resounding answer is yes.

Finextra

JUNE 25, 2025

The sandbox will also apply international ISO20022 standards and the opportunity to test the extended data fields supported for fraud detection and other advancements. Peter Reynolds, EVP, Mastercard real time payments says: “Account-to-account payments in the UK are already an enormous part of the UK’s financial landscape.

The Fintech Times

APRIL 2, 2025

Revoluts analysis showed that Brits are the most vulnerable to WhatsApp fraud , ranking the worst affected in Europe in 2024. “The significant financial losses, particularly from job and investment scams, demonstrate the devastating impact these frauds are having on individuals. Encryption does not equate to immunity from scams.

Stax

MARCH 18, 2025

To address evolving customer demands and accept electronic payments, you need a payment processing system. It authorizes or declines payments based on available funds and fraud checks. According to the US Federal Reserve in 2022, general-purpose card payments reached $153.3 billion transactions and $9.76 trillion in value.

VISTA InfoSec

OCTOBER 21, 2024

As fraudsters are continuously finding new ways to strike, we’re continuously finding new ways to prevent them with controls such as encryption, multi-factor authentication, fraud detection software, etc. Why PCBs matter in cybersecurity When looking for ways to protect our devices against fraud, we always turn to external defenses.

The Payments Association

FEBRUARY 10, 2025

Partnering with regional providers, leveraging AI for fraud detection, and conducting regular audits will ensure compliance, transparency, and operational excellence. Navigating AML obligations in the age of virtual IBANs February 10 2025 by Payments Intelligence LinkedIn Email X WhatsApp What is this article about?

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content