Top regulatory priorities for the payments sector

The Payments Association

FEBRUARY 14, 2025

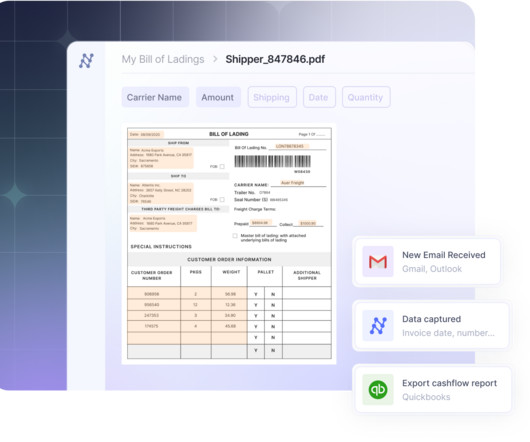

Firms should be prepared for more onerous record-keeping and reporting requirements and factor in the costs of additional compliance obligations, including holding client funds under statutory trust. The Government has confirmed its plans to regulate cryptoassets, which includes regulating for stablecoins simultaneously.

Let's personalize your content