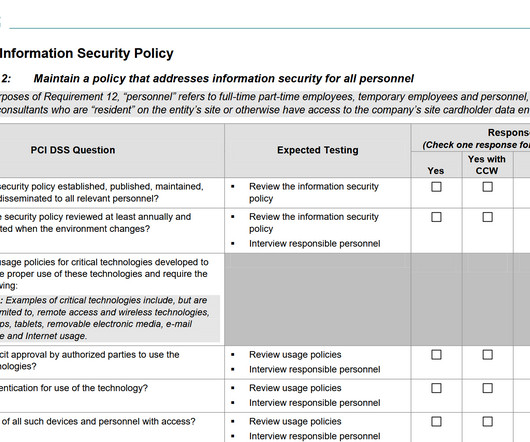

PCI DSS 4.0

Cardfellow

APRIL 27, 2025

You can also check out the PCI at a glance infographic for a quick overview. For simplicity, I will just refer to PCI DSS standards as PCI for the rest of this article. What is PCI again? In the past, Ive written about how to achieve and maintain PCI compliance. Timeline PCI version 4.0

Let's personalize your content