LSEG Risk Intelligence Deploys Account Verification to Tackle Payment Fraud

Fintech News

MARCH 4, 2025

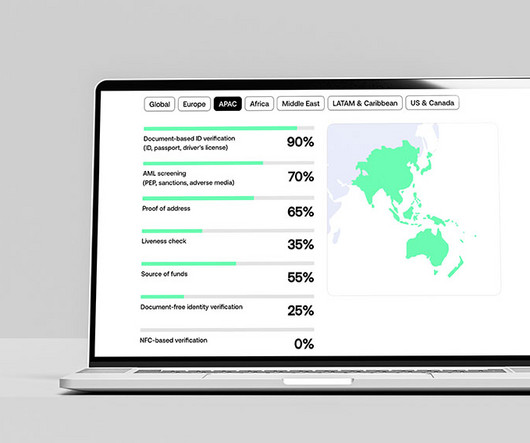

LSEG Risk Intelligence has launched its Global Account Verification (GAV) service in Asia-Pacific and Europe, the Middle East, and Africa, expanding efforts to enhance security in cross-border payments. This helps businesses confirm supplier and customer payments and detect potential fraud risks.

Let's personalize your content