UK Credit Card Trends: From 2008 Crash to Cost-of-Living Crisis

FICO

SEPTEMBER 13, 2022

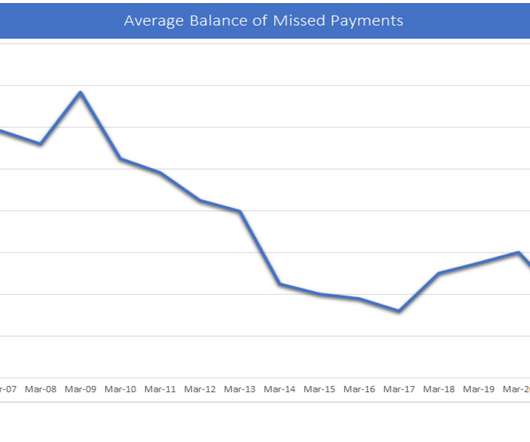

UK Credit Card Trends: From 2008 Crash to Cost-of-Living Crisis. Changes in card management, customer behaviour and regulations make card delinquencies and other trends very different from the crash of 2008. In 2008, it reached a peak of 4.5%. In 2008 it was 5.25% with 4.62% in 2009. Darcy Sullivan. by Liz Ruddick.

Let's personalize your content