FDIC: US Banks See Chargebacks Soar, Profits Tank Due To Pandemic

PYMNTS

JUNE 17, 2020

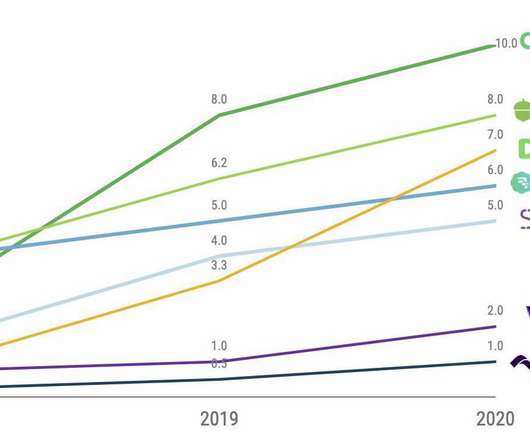

According to the Federal Deposit Insurance Corporation (FDIC), over half of all banks ended up reporting a decline in profits, and 7.3 percent of lenders were unprofitable — the largest number since 2010. billion, Reuters wrote. billion, Reuters wrote. Banks saw a $1.2 percent increase in commercial and industrial loans.

Let's personalize your content