Is Southeast Asia Fintech Funding Drying Up?

Fintech News

JANUARY 13, 2025

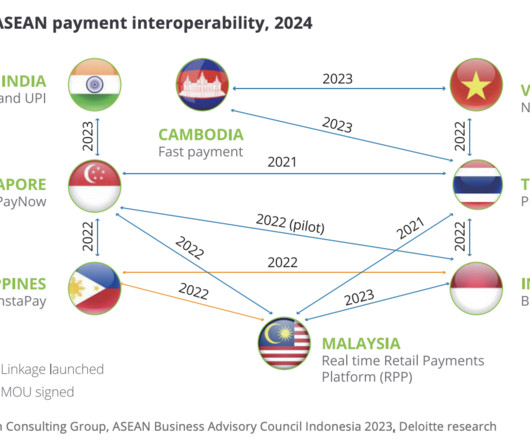

billion in 2023 and a steep 75% fall from 2022s USD $6.3 In 2024, 164 funding rounds were recorded, marking an 8% decline from 2023. from USD $203 million in 2023 and 68% from USD $587 million in 2022. Payments emerged as a top-funded segment, securing USD $366 million, a 53% increase from 2023.

Let's personalize your content