Cybertech: Securing the Foundations of Finance

Fintech Review

APRIL 20, 2025

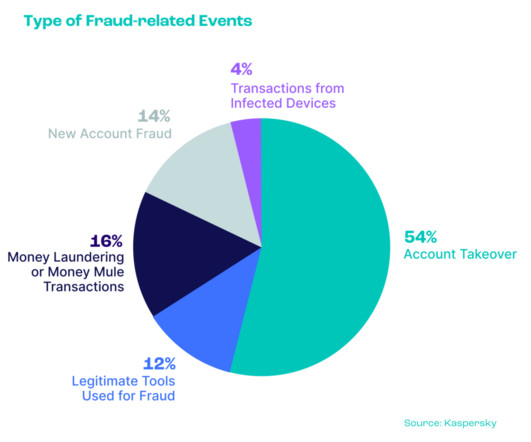

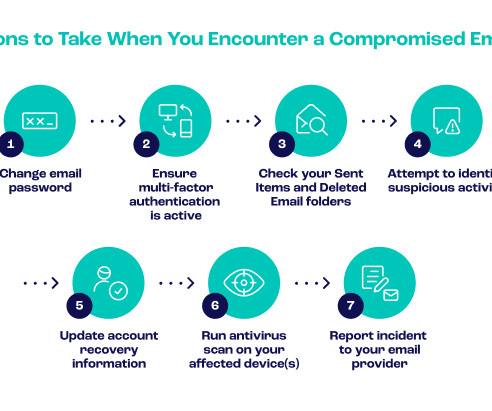

It covers the tools, platforms, and strategies that defend against data breaches, fraud, identity theft, and financial disruption. The risks range from phishing and account takeovers to ransomware and insider threats. Cybertech sits at the intersection of cybersecurity and fintech. What Is Cybertech?

Let's personalize your content