Automating Chargeback Management: First Steps & Best Practices

Fi911

JULY 11, 2025

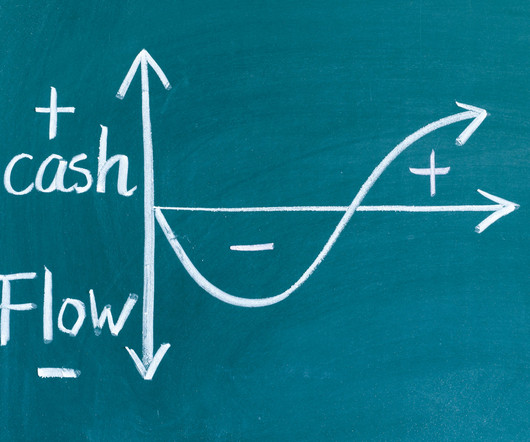

With each dispute costing between $25 and $50 to process manually, automation has shifted from a nice-to-have to a business necessity for many organizations. Financial institutions increasingly view automation as the solution. Key Benefits of Chargeback Automation The most immediate benefit appears in reduced operational costs.

Let's personalize your content