Carrington Labs Partners with Taktile to Streamline Credit Risk Strategy for Lenders

Fintech News

JUNE 25, 2025

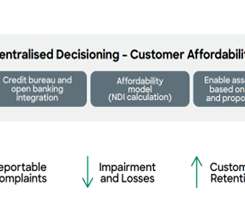

Carrington Labs, a Sydney-based provider of customised cash flow underwriting models and credit risk analytics, has formed a partnership with Taktile, a New York-based decision platform, to assist consumer and SME lenders in refining their credit risk strategies.

Let's personalize your content