What Does the End of the CFPB Mean for Credit Risk Innovation?

The Fintech Times

JULY 1, 2025

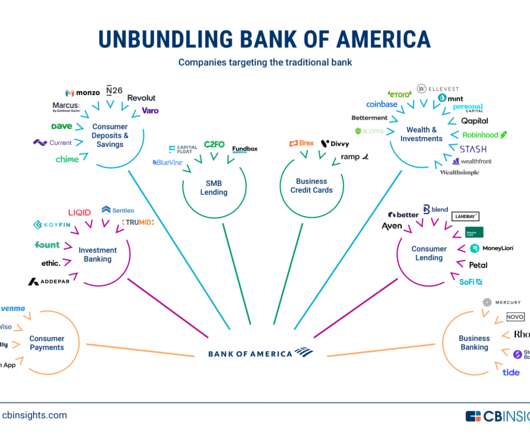

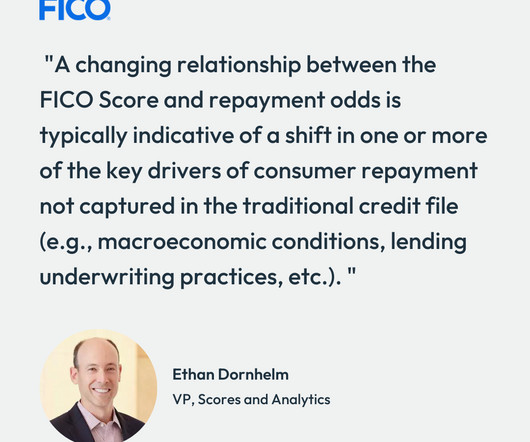

With the CFPB in temporary retreat, lenders may have a window to rethink risk assessment and consider how a broader set of data inputs could help address inclusion gaps responsibly. The missing layer in risk This thinking applies to more than just positive inclusion. It’s a portfolio loss.

Let's personalize your content