Singapore’s Risk Assessment Highlights New Terrorism Financing Concerns

Fintech News

JULY 1, 2024

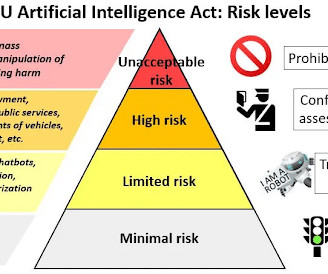

Singapore has released its updated Terrorism Financing National Risk Assessment (TF NRA) and National Strategy for Countering the Financing of Terrorism (CFT) to address terrorism threats. The assessment also notes the rising concern of far-right extremism, although it has not significantly impacted Southeast Asia.

Let's personalize your content