What is Reconciliation in Payments

Clearly Payments

APRIL 17, 2025

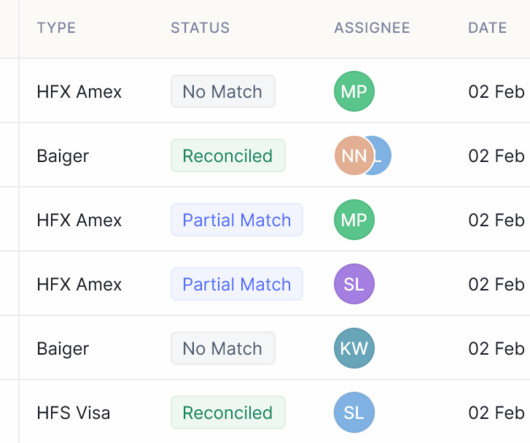

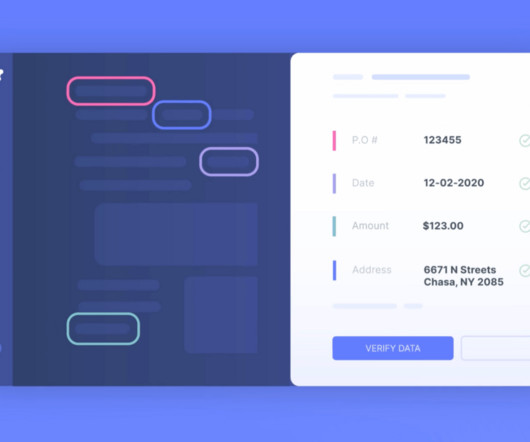

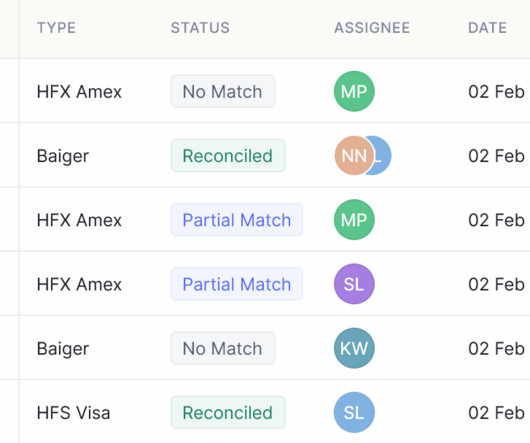

Reconciliation involves making sure that the $10,000 actually arrived, that it matches the sales reports, and that there are no errors, missing funds, or duplicate payments. Fraud Detection Discrepancies in records can be an early warning sign of fraud, theft, or unauthorized transactions. Why is Reconciliation Important?

Let's personalize your content