RTP® and FedNow Transaction Limit Increases Fuel Instant Payments Surge

Fintech Finance

APRIL 24, 2025

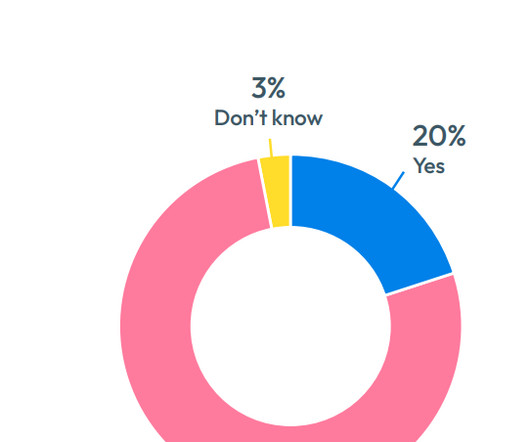

New research from RedCompass Labs shows that RTP and FedNow’s rising transaction limits are making instant payments significantly more attractive for U.S. 84% of US banks say the new $10 million RTP® limit boosts its attractiveness, and 84% believe raising FedNow’s $500,000 cap will have the same effect.

Let's personalize your content