States could pick up where CFPB left off

Bank Automation

MARCH 17, 2025

The uncertain status of the Consumer Financial Protection Bureau could result in more state-based regulations. ORLANDO, Fla.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Bank Automation

MARCH 17, 2025

The uncertain status of the Consumer Financial Protection Bureau could result in more state-based regulations. ORLANDO, Fla.

The Fintech Times

JANUARY 11, 2025

The Consumer Financial Protection Bureau (CFPB) has approved the Financial Data Exchange (FDX) as the first standard-setting body in an important step towards implementing open banking in the US. These standards can help companies to comply with the CFPB’s new open banking rules.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Fintech Times

JANUARY 21, 2025

The Consumer Financial Protection Bureau (CFPB), the consumer protection agency in the US, has hit Equifax with a $15million fine, after it found that the nationwide consumer reporting agency failed to conduct proper investigations of consumer disputes. Equifax processes approximately 765,000 disputes each month.

TechCrunch Fintech

JANUARY 31, 2025

The Consumer Financial Protection Bureau (CFPB) has hit UK-based remittance company Wise with about a $2 million fine for what it described as a series of illegal actions. Those actions include advertising inaccurate fees and failing to properly disclose exchange rates and other costs, the CFPB alleges.

Bank Automation

JANUARY 10, 2025

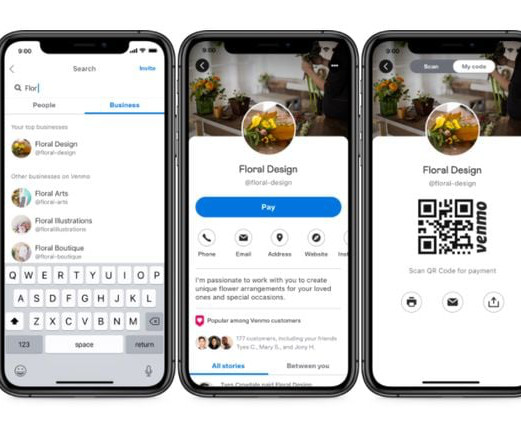

The Consumer Financial Protection Bureau published a request for information today asking the public to comment on data privacy protections on digital payments. When people pay […] The post CFPB requests public comment on consumer privacy protections appeared first on Bank Automation News.

Bank Automation

OCTOBER 31, 2024

The Consumer Financial Protection Bureau fined VyStar Credit Union $1.5 billion VyStar tried to transition to a new online banking platform in May 2022, but the platform failed leaving […] The post CFPB fines VyStar Credit Union $1.5M The Jacksonville, Fla.-based, based, $14.75

Payments Dive

OCTOBER 26, 2023

"With credit card debt crossing the trillion dollar mark, we will be working to prevent bait-and-switch tactics when it comes to rewards,” CFPB Director Rohit Chopra said in a Wednesday press release.

Payments Dive

SEPTEMBER 8, 2023

“Regulations imposed by Big Tech firms have a big impact on whether consumers and businesses can make payments using third-party apps,” CFPB Director Rohit Chopra said in a Thursday press release.

Finovate

APRIL 3, 2025

Plaid’s delayed IPO likely reflects US open banking uncertainty, as the CFPB finalizes its data access rule. Waiting for regulatory clarity and consumer awareness could position Plaid for a stronger public debut down the road. The funding will support employee restricted stock units tax obligations and provide internal liquidity.

PYMNTS

DECEMBER 23, 2020

Santander Consumer USA was ordered to pay $4.7 million to the Consumer Financial Protection Bureau ( CFPB ) for violating the Fair Credit Reporting Act (FCRA), the CFPB said in a press release. The CFPB also alleged in the order that the “internally inconsistent” errors should have been “readily apparent” to Santander.

Bank Automation

JULY 18, 2024

The Consumer Financial Protection Bureau proposed an interpretive rule affecting earned wage products, or paycheck advance products, ensuring that employees are aware of costs and fees for these services, according to today’s CFPB release. Paycheck advance products allow employees real-time access to earned wages.

Bank Automation

JANUARY 30, 2025

Electronic money services provider Wise is being ordered by the Consumer Financial Protection Bureau to pay $2.025 million in a civil money penalty for allegedly misleading U.S. The CFPB found that Wise sent false advertisements regarding ATM fees and free withdrawals, according to todays release from the bureau. clients about fees.

The Paypers

MAY 14, 2025

The US Consumer Financial Protection Bureau (CFPB) has dropped a 2023 settlement with Toyota’s financing arm, as well as its lawsuit against Walmart and workforce payments firm Branch.

Bank Automation

MAY 7, 2024

million by the Consumer Financial Protection Bureau today as the digital bank has failed to give timely consumer refunds. According to Chime’s refund policy, the company is required to issue consumer refunds within 14 days. The CFPB found that Chime has not adhered to this policy, a move that has […]

Bank Automation

MARCH 5, 2025

The immediate future is uncertain for the Consumer Financial Protection Bureau, and it might experience downsizing and less regulatory enforcement, but will eventually rise from the ashes, one of the agencys founders predicted during Bank Automation Summit 2025 on March 4 in Nashville, Tenn.

Payments Dive

MARCH 6, 2025

The Senate backed a resolution to overturn a Consumer Financial Protection Bureau rule that gave the agency oversight of big tech companies offering payment tools.

Bank Automation

DECEMBER 20, 2024

The Consumer Financial Protection Bureau announced today that it has sued Early Warning Services, Bank of America, JPMorgan and Wells Fargo for allegedly failing to implement anti-fraud safeguards on peer-to-peer payments network Zelle.

Bank Automation

OCTOBER 28, 2024

LAS VEGAS — The Consumer Financial Protection Bureau Director Rohit Chopra hopes the financial services industry moves away from screen scraping although the CFPB’s Oct. 22 Section 1033 Open Banking Rule did not ban the practice outright. “I

The Fintech Times

DECEMBER 9, 2024

Google has filed a legal challenge against the US Consumer Financial Protection Bureau (CFPB), the agency responsible for overseeing consumer finance, after it placed Google Payment Corp., The tech giant argues that the move, which the CFPB says is aimed at addressing potential consumer risks, constitutes regulatory overreach.

Bank Automation

NOVEMBER 21, 2024

The top US consumer watchdog will supervise Apple Inc. The US Consumer Financial Protection Bureau will now treat those companies more like banks as long as they handle more than 50 million transactions a […] The post Apple Pay, other tech firms come under CFPB regulatory oversight appeared first on Bank Automation News.

Fintech Finance

MAY 24, 2024

The Consumer Financial Protection Bureau (CFPB) has issued an interpretive rule that confirms that Buy Now, Pay Later lenders are credit card providers. Accordingly, Buy Now, Pay Later lenders must provide consumers some key legal protections and rights that apply to conventional credit cards.

Payments Dive

DECEMBER 3, 2024

With the proposal, the federal agency aims to crack down on fraudsters and others seeking to use sensitive personal information for illicit activities.

Fintech Finance

JULY 15, 2024

Regulatory clarity and consistent standards are critical for providers offering safe, transparent and responsible financial services and even more important for consumers who expect protections when utilizing financial services including Buy Now Pay Later,” said Phil Goldfeder, Chief Executive Officer of AFC.

PYMNTS

APRIL 13, 2020

The Consumer Financial Protection Bureau (CFPB) has made it easier for people to access stimulus CARES Act funds by removing some of the legal barriers barring banks from issuing the payments through prepaid accounts, according to a press release. CFPB Director Kathleen L. Many have been laid off as a result of that turmoil.

PYMNTS

DECEMBER 23, 2020

The Consumer Financial Protection Bureau (CFPB) has settled with student loan servicers Discover Bank , The Student Loan Corporation and Discover Products (collectively Discover) in a 2015 case for unlawful practices, and Discover will have to pay $10 million in customer redress, a press release says.

Fintech Finance

JULY 19, 2024

The Consumer Financial Protection Bureau (CFPB) has proposed an interpretive rule explaining that many paycheck advance products, sometimes marketed as “earned wage” products, are consumer loans subject to the Truth in Lending Act. The CFPB also published a report examining employer-sponsored paycheck advance loans.

PYMNTS

DECEMBER 30, 2020

Payactiv 's Earned Wage Access (EWA) program is exempt from federal lending law under new rules from the Consumer Finance Protection Bureau (CFPB), according to a press release. The CFPB recently clarified its position on EWA programs and said they weren't considered to be extensions of credit.

Payments Dive

NOVEMBER 3, 2023

The digital payments company said it’s cooperating with a Securities and Exchange Commission probe of its stablecoin, and a Consumer Financial Protection Bureau inquiry related to bank transfers.

Finextra

AUGUST 14, 2024

Responding to a call from the US Treasury, the Consumer Financial Protection Bureau (CFPB) and the American Fintech Council (AFC) have both weighed in on the use of AI in financial services.

Payments Dive

NOVEMBER 9, 2023

Consumer Financial Protection Bureau supervision “levels the playing field” in buy now, pay later, Affirm’s CEO Max Levchin said Wednesday.

Payments Dive

MARCH 14, 2022

In a rare TV appearance, the director of the Consumer Financial Protection Bureau said that the payments industry isn't competitive enough and that fee hikes by the big card companies would add "insult to injury" at a time of inflation. He noted new fintech tools could ultimately be a benefit if they add competition.

Payments Dive

MAY 21, 2024

“Whether a shopper swipes a credit card or uses Buy Now, Pay Later, they are entitled to important consumer protections under longstanding laws and regulations,” CFPB Director Rohit Chopra said.

Finextra

NOVEMBER 8, 2024

The Consumer Financial Protection Bureau (CFPB) has charged the US’s largest credit union for illegally charging users overdraft fees.

Payments Dive

OCTOBER 20, 2023

The rule makes it easier for consumers to share deposit account and credit card data with fintechs, the Consumer Financial Protection Bureau said.

Payments Dive

FEBRUARY 1, 2023

The Consumer Financial Protection Bureau proposed a new rule that would effectively cap credit card late fees and potentially save Americans $9 billion.

Payments Dive

APRIL 3, 2024

The Consumer Financial Protection Bureau received 70,000 card-related complaints from consumers last year, according to a report last week.

Payments Dive

JANUARY 14, 2025

Consumers who use BNPL take out multiple loans and have more personal debt than consumers who don’t use the payment method, according to a new report from the Consumer Financial Protection Bureau.

Bank Automation

AUGUST 23, 2024

The Consumer Financial Protection Bureau is facing additional challenges that call into question the legality of the bureau’s funding. The Supreme Court upheld the CFPB’s funding mechanism in May. In several recent lawsuits, companies sued by the CFPB for violations argue that the bureau is using funds it should not have.

Payments Source

APRIL 13, 2020

The Consumer Financial Protection Bureau wants to make it easier for those who lack bank accounts to receive pandemic relief payments authorized by Congress.

Bank Automation

DECEMBER 23, 2024

and one of its financial technology partners allegedly opened expensive bank accounts for delivery drivers without their consent, a US consumer protection agency said on Monday. The Consumer Financial Protection Bureau claimed that Walmart and Branch Messenger Inc. Walmart Inc.

Bank Automation

SEPTEMBER 11, 2024

TD Bank was ordered to pay $28 million in fines by the Consumer Financial Protection Bureau, which ruled the bank had shared inaccurate information about its customers to consumer reporting companies. Consumer reports are used by financial institutions and other lenders to determine access to credit, housing or employment.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content