Get Paid Faster: Adopt an AI Solution That Integrates Credit Decisions into Your CRM

Trade Credit & Liquidity Management

JUNE 23, 2025

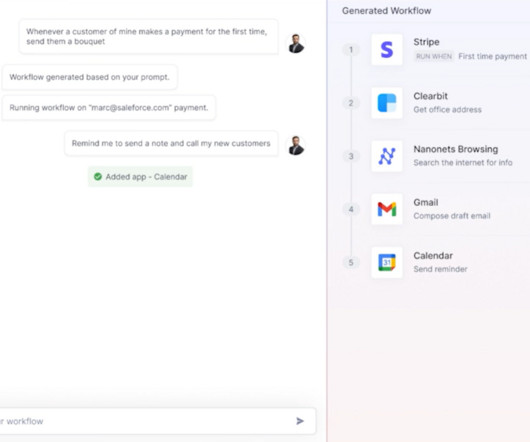

Sales teams operate without visibility into credit risk or when slow payments may affect subsequent sales to a customer. In addition, finance teams operate without knowing how that risk is being translated into contracts and payment terms. No delays, no chasing finance.

Let's personalize your content